How To Be A Better CEO and Leader

07/12/2021

Insider Risk: A Cybersecurity Threat Least Talked About in The Industry

07/30/2021What Is Financial Due Diligence in M&A

I realized about a year ago that Financial Due Diligence in M&A was an obscure notion for a lot of people, including entrepreneurs and people working in corporate finance.

Yet, most of the skills that are the most useful to me when it comes to reviewing Private Equity investment opportunities, doing fundamental analysis of a publicly listed stock or managing an M&A process, I acquired doing Financial Due Diligence.

That is why I decided to help people interested or engaged in a career in corporate finance and finance analysis by making the tools and techniques used in Financial Due Diligence accessible and easily understandable.

To do that I’ve put together a full step by step online Financial Due Diligence course that builds on years of hands-on experience to provide a clear framework on how to review the financial statements of a company to spot red flags and drive insights.

So for anyone out there wondering what Financial Due Diligence really is, curious enough to learn more and eager to step up their game and skills in financial analysis, here is an overview and breakdown of the diligence process:

Overview of What is Financial Due Diligence In M&A

In most cases, due diligence is required in the context of any event where an important new stakeholder is considering being financially involved with a new Target company.

More specifically, due diligence experts will be needed in the following contexts:

- A capital raise involving private equity investors or venture capital

- A transfer of ownership of part or all of a company’s equity (e.g. an acquisition)

- A merger between two strategic players on a given market

- An IPO (initial public offering), i.e. a private company becoming public

- A public-to-private transaction (e.g. a listed company acquired by a privately own company)

- A debt financing event

What Is The Purpose of Due Diligence?

Due diligence is meant to provide buyer / investor with a clear and comprehensive understanding of the Target business and to spot any potential red flags that may endanger the perennity of the company post-acquisition.

There are several types of due diligence:

- Financial Due Diligence (FDD)

- Commercial (ie analysis of the market)

- Tax (ie. assessing risk around tax structure and if a company is not at risk of unpaid tax litigation)

- Legal (ie. do contracts abide by the law, are there any ongoing litigation etc)

- Operational (which are there to get comfort about the efficacy of the target’s operations, identify any risk and assess how scalable the business operations are. ODD will also assess potential synergies in the case of a strategic acquisition, or additional needs for a carve-out business.

- IT (here to verify whether the whole IT infrastructure is solid, the code reliable, well organized and well documented, cyber-security on point etc.)

In short, due diligence is there to do an in-depth assessment of a specific aspect of a company. In my career I have specifically developed an expertise in Financial Due Diligence in M&A (FDD) and will be focusing on FDD for the rest of this post.

What Are The Main Objectives of Financial Due Diligence in M&A?

If I were to summarize the main goals of a Financial Due Diligence in M&A over three main points, it would have to be :

- Provide a clear and deep understanding of the revenue generation and profitability structure as well as understand business valuation of the Target

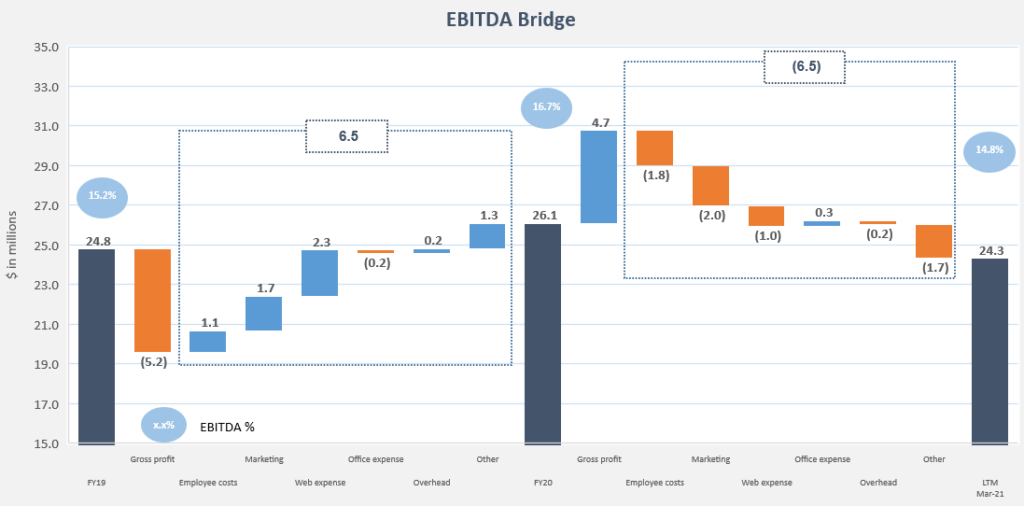

- Provide a normalized view of financial position and aggregate impacting deal value (EBITDA, Net Debt, Net Assets, Cash Flow, Net Working Capital, Fixed Assets, Capital Expenditure, Prepaid Expenses, etc.)

- Use a fact-based approach of historical performance to assess the feasibility of the financial forecast and future growth.

What is also important to highlight to better understand the context of a Financial Due Diligence work is that, as an M&A consultant, a FDD is meant to be an independent review with key assumptions of a Target’s financial statement.

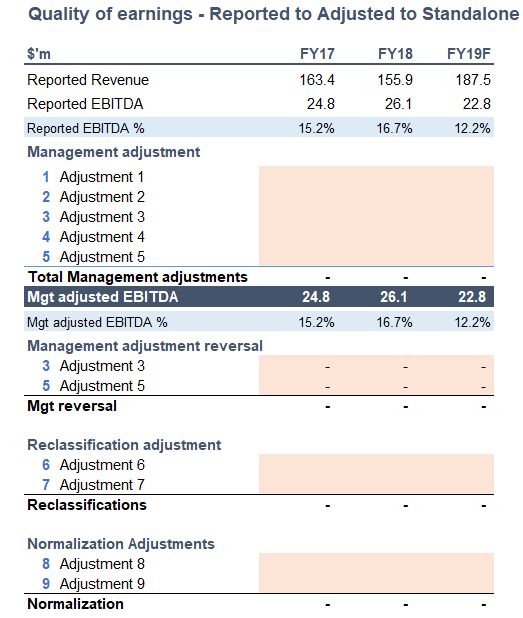

One of the main sections of a FDD report (sometime the only one that really interests a client) is going to be the Quality of Earnings section that, as mentioned in point 2 above, seeks to present a normalized view of the Target’s EBITDA.

What Are The Big Types of Projects of a Financial Due Diligence M&A Team?

There are 3 major types of projects a Financial Due Diligence team will be working on in major M&A consulting firms providing Transaction Services

1. The Vendor Due Diligence (VDD)

The client is the Seller / Target company.

They ask the FDD team to do a comprehensive and independent audit of their accounting prepared financials including the balance sheet, unrecorded liabilities and other risk in the business going through a diligence checklist. This generally helps the seller be better prepared for a deal by uncovering potential issues early in the process.

When multiple bidders are involved in the process, it also allows Target’s management to save a lot of time by providing every potential buyer with a comprehensive earnings analysis of their business and avoid them to answer the same questions over and over again.

VDD usually last longer than buy-side engagements and access to accounting information is easier for the FDD team since the Financial Due Diligence team is working hands in hands with the Seller’s team.

However please note that sometimes there may be some internal conflicts with some of the Top Management who may be unhappy with the sale of the business and which may create obstacles to the work of the Financial Due Diligence team.

2. The Buy-Side Due Diligence

The client is the acquirer / investor.

Generally, in buy-side, access to information may be more limited than if you are performing a Vendor Due Diligence, and your report will generally be less exhaustive than a VDD because your client may have a specific scope of work in mind, in other words certain areas of the business they specifically want to get comfort about.

It is also common, especially for large size deals, that a buy-side due diligence be mostly done on the basis of the VDD. The role of the Financial Due Diligence team is then to challenge the findings presented in the VDD and potentially derive additional analyses to uncover new findings from the financial information.

I think it is important to note here that yes, in theory due diligence reports are an independent review of a Target and there should not be difference between findings and conclusions in a buy-side and a sell-side report.

The reality is that there are several items where the FDD team can decide to take a more or less aggressive view (on Quality of Earnings (i.e. EBITDA adjustments for instance). Also, a client may push for some analyses to be removed or amended.

Overall, the FDD team may agree on a few tweaks to make their client happy but won’t budge on the key messages and analysis. Their reputation is on the line, and this is generally their most valuable asset!

3. The Vendor Assistance

The Vendor assistance is less “formal” than a VDD or a Buy-Side report. The goal here is not to provide a view, but to help the seller prepare for a Transaction by helping them clean their data. In a vendor assistance engagement, the FDD team can also help with preparing stand-alone financial records in the case of a cash carve-out for instance.

In the case of a Vendor Assistance, the Financial Due Diligence team basically helps their client prepare the data that will be used by the buy-side due diligence team. In a sense, a VA is a lighter version of a VDD and as such does not need to be as exhaustive. acq

Who will use a FDD report?

The financial reporting will obviously be read by the potential buyer, but it may be shared to other financial professionals or the investment banker. Here is a quick overview of who can use a Financial Due Diligence report and how they would use it.

- Potential buyer, to prepare their own forecast and refine their business valuation of a Target company.

- Board of directors to agree on the details of a Transaction including valuation

- Banks, to agree on a certain amount of financing and cash injection needed

- A Financial Due Diligence report prepared by a renowned and respected firm may also weight in the negotiations by providing an expert eye on technical points and providing and independent review of a normalized EBITDA in the financial modeling and internal audit

- Also, the reality of the market is that having one of the big 4 sign-off on a Financial Due Diligence report and showing that no substantial transactional risk has been found is a way for decision makers to give away the responsibility if anything negative is uncovered Post-Transaction.

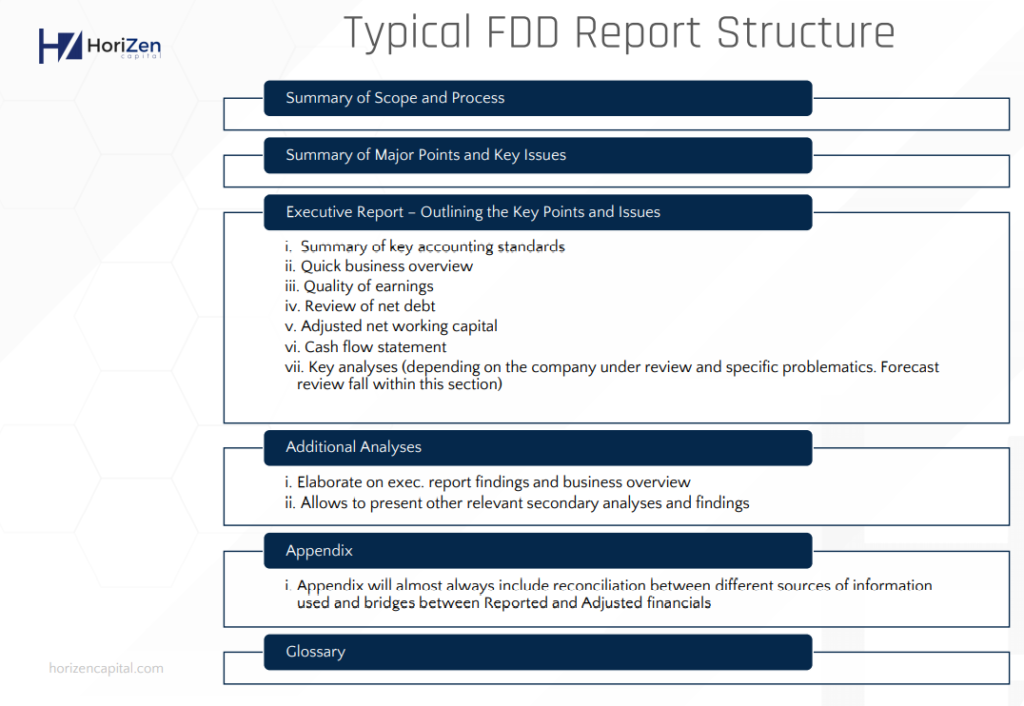

Usual structure of a FDD report

The content of a Financial Due Diligence report will change from one company to the other because every target is different and every situation may need specific analyses and audit information.

Also, the report will change based on the scope of work initially agreed on with the client.

From experience, as a rule of thumb a report will go from around 30 pages (powerpoint) for a small company with a limited scope of work and up to 200-300 pages for a multi-billion dollars company.

A typical financial due diligence report structure would start by a summary of the scope and process, then present the 6 to 12 main points of attention of the report before moving to the exec summary, then additional analyses and finally appendix and glossary.

I’ve included an overview of such a structure below.

In Summary

If you’re interested to learn more on how to review the financial statements of a company to spot red flags and drive insights check out Horizen Capital’s Financial Due Diligence course that’s built on years of hands-on experience to provide a clearer framework and help you get a better financial analyst or land your dream job in transaction services, Private Equity, accounting, investment banking or M&A.