Official Launch of HoriZen – Acquiring SaaS Companies

01/30/2020

5 Key Steps on How to Value a Business

04/17/2020Software as a Service (SaaS) is a rapidly growing market, with many businesses utilizing it to offer their software services to a huge global audience and maximize profits. SaaS has revolutionized how businesses meet consumer needs and the traditional structure of a company has changed entirely. It’s a unique industry that provides a whole host of benefits, both to businesses and clients, but this new way of working does bring with it a few difficulties.

HoriZen Capital, a SaaS firm, backed by a group of investors who’s in a unique position to understand how to value a SaaS company as we have witnessed many companies raise equity or exit in the last 5 years. The exits have been a combination of strategic sales and private equity recaps and have provided us an effective way to benchmark private SaaS valuation multiples against public SaaS company data.

One of the most discussed topics around SaaS valuations is when it’s time to sell. With a unique industry comes unique considerations, and how you value what you offer may be entirely different from what you’re used to as the SaaS owner. To help clear things up and provide a clear perspective on how you can value your SaaS business in 2023, our financial experts have put together everything you need to know, including which metrics you should be pinpointing to measure and how you can increase your SaaS companies value before a sale.

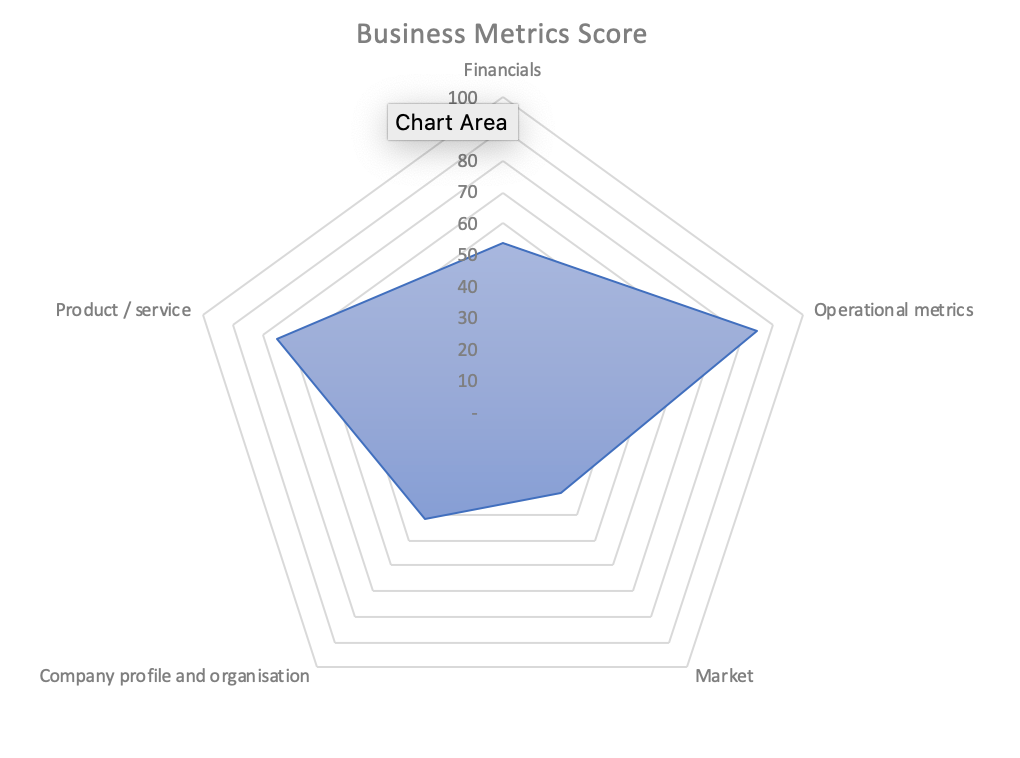

If you’re the owner of growing SaaS startups, you know what it takes to build it into a successful enterprise—and chances are you’ve wondered how much your business is worth. When arriving at an accurate valuation of a given SaaS business, an established M&A advisor will take dozens of factors into consideration in order to take a holistic view of the business.

In this piece, we walk through the basics of valuing SaaS businesses, with a specific focus on areas where owner intervention can positively impact the value of the business.

How to Value a SaaS Business

Before you begin the SaaS valuation process, you need to first look at the differences between SDE, EBITDA margin, Revenue and understand your future cash flow and decide which is right for your business depending on your size and growth.

A private SaaS company’s valuation (valued under $5,000,000) are best suited to use a multiple of seller discretionary earnings, also known as SDE. SDE is a value of the profitability after all operating expenses and cost of goods have been subtracted from the final gross income, and any owner salary or dividends can be included in the profit value. It’s a valuation method that helps show the underlying earning potential of the company, and the owner’s salary being added back into the profit is a crucial element of this.

SDE = Profit on Income Taxes + Non Recurring Expenses – Non Recurring Income + Non-operating Expenses – Non-operating Income + Depreciation + Amortization + Interest Expense + One Owner’s Total Compensation

As business growth increases in larger companies (worth over $5,000,000), the way SaaS business valuation changes from SDE to EBITDA, also known as earnings before interest, taxes, depreciation, and amortization. Due to larger SaaS companies often having a more complex ownership structure, with shareholders and CEO’s included in the mix, any owner salaries, compensation, and discretionary expenses should be put back into the business rather than added onto profit to calculate the final, true value.

EBITDA = Net Income + Interest + Taxes + Depreciation + Amortization

For many smaller SaaS businesses, these two methods are enough to properly value the earning potential. However, founders can find complications with using these, and the EBITDA margin currently generated could stand at zero and isn’t an accurate representation of future earning potential. This is when the calculation of revenue should be used instead, which looks at current and future growth to provide a more accurate forecast of the SaaS multiple.

To summarize, if the business is reliant on the SaaS founders, has a growth of less than 50% year on year, and/or generates less than $5,000,000 revenue in a year, SDE can be used. If not, EBITDA or revenue may be a better way to properly assess your SaaS company’s valuation.

Factors that Impact SaaS Valuations

If an investor is looking to buy a SaaS company, they’ll want to identify where the strengths and differentiating features lie to better understand the value. To do this, they’ll look at a few different key metrics, including the following:

Churn – Your customer churn rate is the amount of customers who leave your service over a given period of time, usually recorded as a percentage. It can tell investors a lot about a business model and whether it’ll be successful over time; for example, high churn would indicate the SaaS concept doesn’t fit users; needs or falls short of expectations. There is no clear figure for an acceptable churn rate, though you should try and keep it below 10% – which is usually a more common and acceptable figure in competitive industries or where the software is designed for short term use – and less than 5% revenue churn is ideal to show customer retention.

How To Calculate Monthly Churn Rate

CAC – CAC, also known as Customer Acquisition Cost, is how much money it takes to acquire one new customer, measuring marketing and sales costs. The less you spend here the more appealing you’ll look for potential investors, although every SaaS business has varying figures when it comes to CAC so it can be hard to show the true value metric.

How to Calculate Customer Acquisition Costs (CAC)

CAC = (Total Marketing Expenses + Total Sales Expenses) / # New Users Acquired

LTV – This is when LTV, or Customer Lifetime Value, is also applied. This calculates the average recurring revenue earned from one customer throughout their time with your business. The higher the LTV, the more valuable each new customer, and the more acceptable a higher CAC figure will be.

How to Calculate LTV

LTV = ARPU / Revenue or Customer churn

You should always look to have a higher LTV than CAC, and the ideal LTV/CAC ratio for the average SaaS company is anything above 3, meaning for every dollar you put in your SaaS machine you’re getting 3 out. If you can achieve a ratio of 3 you can scale the growth of your SaaS startup while maintaining a healthy profit margin.

Monthly Recurring Revenue (MRR) Vs. Annual Recurring Revenue (ARR) – In terms of top-line revenue, it can be tempting to offer annual or even lifetime plans to new customers. Whilst this may benefit the business growth in the short-term, it will hold your SaaS company’s valuation and pricing back when it comes to valuation as ARR (annual recurring revenue) is seen as less predictable than MRR (monthly recurring revenue). If you do offer annual plans, look for an MRR to ARR ratio of 5:1 to prevent your SaaS valuation from being affected. In general, the more attractive SaaS companies have at least 80% of their revenue being generated on a recurring basis.

How Much Is My SaaS Business Worth?

By looking at the metrics of your business, you can better value your SaaS business in the eyes of an investor or venture capital firm. After looking at the above metrics, here are other factors to take into account when determining SaaS companies valuation multiples:

- Age of your business – If your SaaS business is older than 2 years, it’ll be valued higher than a younger startup, and upwards of 3 years is preferable for most investors. This is because you’ll have a longer track record and more data to present, and any patterns of sustainability will be seen as more reliable. If your business is younger than 2 years, it will be able to sell though expect it to be harder as the investor or future business owner will deem the investment as higher risk.

- Owner involvement – SaaS businesses tend to have passive earning potential with predictable income, and businesses that require less owner involvement with an existing management team will be far more attractive to potential buyers. If your company already has a team in place to run your SaaS, which includes an outsourcing process, and require little time from the SaaS founders your value to investors will immediately increase. On the other hand, if the owner is still doing all the sales of the business and is working 40+ hours per week on a full time basis, in the business, it becomes less attractive as the business’s success is then too reliant on the previous owner and the risk increases significantly.

- Market Trends – Whilst you won’t want to sell a SaaS company that’s rapidly growing with current trends, it’s also important to remember that investors don’t want to buy a company that’s in a declining market. The ideal middle ground is a business that is constantly trending and, if possible, is usually growing.

- Growth Rate – The quicker and more predictable your SaaS companies revenue growth rate, the more premium it’ll appear to potential buyers. Generally they like to see a growth rate increase in gross profit, recurring revenue, cash flow, gross margin, positive or negative EBITDA margin improvements, expansion revenue and customer retention..

How to Increase the Value of Your SaaS Business Before a Sale?

Before you look to sell your business and it’s assets, you need to create an exit strategy and increase revenue growth to increase the value. One way to do improve SaaS valuations is by reducing churn rate, which can be done through a variety of clever processes, such as detecting when a customer is thinking of or going to leave and offering new incentives to keep them on and maintain higher net revenue retention.

6 Ways To Reduce Churn in your SaaS Business

1. Ask your customers. Analyze why churn occurs by speaking and engaging with your existing customers. Run NPS surveys and truly understand objectively what you can do to improve your product.

2. Offer incentives. Offering incentives and discount offers in your pricing is widely regarded as the most effective tactic in reducing churn and improving net revenue retention.

3. Target the right audience. It’s better to target those who appreciate the long-term value of your product and your value proposition and see the price as an investment in good quality. No matter how sophisticated your retention tricks are, they may all go down the drain if you are attracting the wrong audience.

4. Give better service. Poor customer service is the leading case of customer churn.

5. Pay attention to complaints. Complaints are like tips of the icebergs – they suggest that the bigger part of the problem is hidden from the view. In fact, 96% of unhappy customers don’t complain, and 91% of those will simply leave and never come back.

6. Offer long term contracts. Instead of the month-to-month contracts, try offering a longer subscription business model in your SaaS pricing. In such a way your customers will have enough time to implement the product and see the benefits of using it while increasing lifetime value.

You can also outsource both your development and customer support departments to make your business more appealing to an investor looking for a passive owner opportunity and reduce replacement of owner compensation costs, and document and test your source code to secure a higher SaaS valuation.

The final point to remember before selling your discount is to avoid offering sudden discounts on annual plans to increase short term revenue growth and gross profits. Though it may be tempting, buyers will easily be able to see what’s been done and will either disregard the months in which the sale was taking place, or may even move on from your business entirely. Instead of discounting, continue to run your business as you have in the months before you decide to sell – unless there is a seasonal event such as Black Friday that would warrant the discount – and instead focus on implementing the changes that will add value.

Why Sell Your SaaS Business?

Once you know more about valuing SaaS businesses, it’s time to look at why you would want to sell it so you can make a final decision – you want to avoid jumping into the sales process and finding a buyer only to later back out. One of the biggest reasons to sell a SaaS business that’s doing well is to avoid future risk. Though it may be small, there is a chance that in the future your business is going to fail.

Your market could be suddenly made obsolete by new technology, or a competitor could monopolize the industry; there is a multitude of possibilities that make continuing to run your company a risk. On the other hand, selling and receiving a lump sum is risk free.

If you grew your business from an idea to a fully functioning SaaS company, there’s also a matter of taking that win to avoid a loss. Getting out whilst it’s on the up secures you the success of launching your own, profitable company. It also leaves you time to start looking at other projects, particularly if this was more of a ‘means to an end’ rather than something you were passionate about as a SaaS entrepreneur. Once you’ve sold your software company and have the safety net of money from the sale, you can take more risks creating a new business that you love without the fear that may have held you back creating your first SaaS company.

Final Thoughts

Now you know all about the valuation multiple, exit strategy, enterprise value, top SaaS metric to pay attention to and sale options for your SaaS business, the best way to get a good sense on how much your SaaS company valuation is, is to speak a SaaS Private Equity advisor. They will be able to calculate your SDE accurately from your gross profit and advise on the applicable multiple based on their assessment of the business and previous transactions.

A SaaS advisor will give you the best advice on exit strategy and timing and more accurate SaaS valuations irrespective of whether this is in their short-term interest. The best advice might not be to sell right now, instead, to do five things (eg. better SaaS margins, focus on more Enterprise SaaS clients, improve your net profit, adjust your pricing strategy or even increase by 2x, 5x or even 10x revenue) to maximize valuation multiples and come back in 3-6 months with to demand higher revenue multiple or EBITDA multiples to list your business for sale. A win-win for everybody.

Looking to sell your software company in the near future? Get a Free Business Valuation from one of our M&A advisors, at our private equity SaaS Firm.