Horizen Transaction Services

If you are looking to invest in or buy-out a SaaS company and want a high quality review of the target’s financial situation prepared by seasoned professionals who understand the in and out of the online subscription model, we’re the perfect advisors for you.

At HoriZen Transaction Service, we are the team where Big 4 financial due diligence expertise meets SaaS operational and advisory expertise. Because SaaS and financial advisory are what we do all day.

We’ve also built the course about financial due diligence and how to perform a quality of earnings (QofE) analysis.

Depending on your needs, existing level of comfort and how extensive you’d like your financial due diligence report to be, we offer two FDD package pricing options.

High Level

High level presentation of P&L, Balance Sheet and operation metrics (Churn rate, LTV, CAC etc.)

Review of target main sources of financial information

Descriptions of the different points of attention we recommend you to dig further and sort out with seller

List of items with the potential to be quality of earning adjustments and may impact the value of the deal

Comprehensive

Personalized quote on request

Detailed review of P&L, balance sheet and cash flow

Quality of earnings

In depth review of historical revenue and profit trends

Quality of net debt

Normalized net working capital analysis

Budget accuracy and assessment of forecast

Review of accounting principles used and their impact on financials

Direct call sessions with target’s Management

Direct call sessions with target’s Management

Reconciliation of different sources of information provided

Reconciliation of different sources of information provided

Review of accounting principles used and their impact on financials

Review of accounting principles used and their impact on financials

Check of cash position vs. bank statements

Check of cash position vs. bank statements

How Do We

Bring You Value

Get a comprehensive report on the financial health of the SaaS company under review

Understand historical business value drivers and shortfalls

Get an accurate picture of the SaaS business and operation metrics before investing

Deleverage your risk by identifying potential issues upfront

Get an assessment of the achievability of the team’s forecast

Base your SaaS valuation on adjusted and more reliable numbers

Spot any recent change in the SaaS business historical and recent trend that can impact the transaction

Use our quality of earnings, net debt, cash flow and net working capital adjustments as part of your negotiation with buyer

How Long

Does a

Report Take?

If an investor is looking to buy a SaaS company, they’ll want to identify where the strengths and differentiating features lie to better understand whether the target is a good acquisition.

For a red flag report, we generally expect a 10 day turnaround from the moment we receive the information and documents.

For a full report on a sub-$10m ARR business, it will usually take 3 to 4 weeks to complete all the checks and analyses, assuming that we receive documents and answers from Management in a timely manner.

Process and

Diligence Checklist

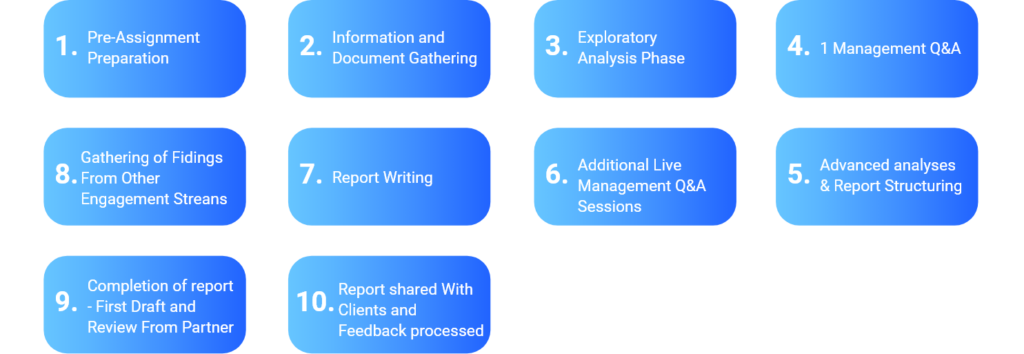

Each financial due diligence is different and tailored to the specific SaaS business we review, however here are what a general due diligence roadmap and diligence checklist look like in a simplified way.

1.

We discuss your current understanding of the business, specific problematic you’d like to better explore and what areas of the transaction are most important to you. This helps us define the most efficient scope of work to answer your questions.

2.

We send an extensive request list to the target, asking for financials, operation metrics, business presentation and documents that will allow us to kick-off our process.

3.

After a first review of all the documents, we’ll organize a call with Management to confirm our understanding of the information provided and ask detailed questions about the nature of key accounts, historical and recent trends, accounting principles, internal processes and forecasting methodology.

4.

Next on our financial SaaS due diligence checklist, we put together a full report based on all the information received that offers a clear and articulated view of the business operations and profitability profile. We will generally request one or two additional calls with management to sort out and answer questions that arise from our in-depth review of the numbers.

5.

We finalize our process by sharing live our insights with you and highlight potential red flags.

Usual FDD Process

Every process is different, however based on our experience, here would be a description of a “typical” project.

1. Pre-Assignment Preparation

5. Gathering of Fidings From Other Engagement Streans

9. Completion of report - First Draft and Review From Partner

2. Information and Document Gathering

6. Report Writing

10. Report shared With Clients and Feedback processed

3. Exploratory Analysis Phase

7. Additional Live Management Q&A Sessions

4. 1 Management Q&A

8. Advanced analyses & Report Structuring

SaaS Financial Due Diligence process

Specifically for SaaS due diligence, we will request access to tracking tools widely used by online subscription model businesses like Chartmogul, Profitwell and Stripe.

These tools provide a significant part of the data listed on our due diligence checklist and help us prepare our analyses without taking too much of Management’s time.

The Importance of

Financial Due Diligence

SaaS due diligence is the process in which you review and professionally assess all the different parts of a business that can have an impact on its future success or potentially jeopardize a deal.

Because Financial Due Diligence is so important, we think it’s important to educate entrepreneurs to what Financial Due Diligence look like, and help online entrepreneurs understand the role of SaaS FDD.

During a SaaS due diligence process you will want to do an in-depth review of the team, the product, the technology, the financials but also to check the conformity of the target’s business operations from a legal and a tax point of view.

SaaS financial due diligence in particular is the process in which you assess in details the accuracy of the financial information provided by a target SaaS company and the solidity of their business and financial performance and operation metrics.

It is key to go through this process before investing. This will ensure that you perfectly understand the financial stability of the business and significantly reduce your risk of bad surprises post-acquisition.

Quality of earnings and understanding of net debt in particular are key to assess the normative level of profitability of a business and agree on price adjustment to bridge from enterprise value to equity value at closing.

Our Speciality Is

SaaS Due Diligence

The SaaS business model is very specific, and not fully understood by everyone, not even seasoned advisors. Understanding the specificities of the SaaS business model helps us be more efficient, more relevant and to ask the right questions.

Also, since we know what we are talking about, the dialogue with the seller is always better as they recognize and appreciate our knowledge, technical expertise and understanding of their business.

Being SaaS specialists and having SaaS operators in our team, we understand the importance of key metrics that are customer churn, revenue churn and revenue churn rate, average customer value, customer acquisition cost, one-off vs. recurring revenue, and all the key areas any SaaS companies and PE funds or family offices investing in SaaS companies are interested in.

The SaaS Metrics

We Review

At the top of our Saas due diligence checklist, we pay a close attention to the classic operation metrics monitored by all Software as a Service companies and by all managers of a recurring revenue business, regardless of the vertical the company operates on.

Here are a few examples of the most common metrics used by SaaS operators and reviewed during SaaS financial due diligence.

Top 5 Metrics:

Gross and net churn rate, or customer retention figure

Lifetime customer value (LTV)

CAC/LTV

CAC payback period

Customer acquisition cost (CAC), also called customer lifetime value

While everyone operating a SaaS business track these metrics, it is important in a financial due diligence process to properly understand how these metrics are calculated by the target.

Key Considerations:

How are returning customers, upgrades and downgrades taken into account in the customer churn calculation?

Is the LTV a basic customer lifetime value calculated as 1/customer churn rate or is this metric based on more accurate historical numbers.

What costs are allocated to the CAC ? And are these allocated costs properly allocated by product?

Are the metrics monitored on a simple basis or on a cohort basis?

Two Main SaaS Sales Models:

Low-touch business model mostly driven by an efficient digital marketing strategy and automated on-boarding process.

High-touch sales business model, which generally corresponds to SaaS companies selling to large and Enterprise customers and involving a longer sales process handled by sales associates

Real life example of

a Transaction

HoriZen Transaction Service team members worked on hundreds of transactions combined.

On one noticeable transaction, the company P&L was prepared on a cash basis (as opposed to on an accrual basis), which meant that revenue was recorded in the book for the full amount of when the subscription payment was received in the company’s bank account.

The company under review was allegedly doing well and was showcasing an increase in total revenue vs. previous year, and the asking price was a multiple of last twelve months revenue.

However after analyzing the top line in more details, it appeared that more and more existing monthly customers were switching to annual subscription.

It meant that for these customers the last twelve months financial results included more than 12 months of revenue (the X months they had been monthly customers + the full amount of their annual subscription).

The above finding meant that the price of the company would need to be revised by at least 15%, but also that the trend and growth profile of the company was not as attractive as it originally seemed.

With SaaS valuation being often tied to revenue and revenue growth, this significantly impacted the dynamic of the deal.

What Recurring

Analyses We Do

To each SaaS business their own specific approach, however when analyzing a recurring revenue / subscription model business there is a set of usual analyses that we will perform to help you better understand the historical trends of the business.

On top of the Quality of Earnings, net debt analysis, cash flow statement and net working capital normalization, there is a multitude of analyses useful to a buyer or an investor: revenue seasonality, price volume mix analysis, revenue and EBITDA bridge, DSO, DPO just to quote a few.

Here is a more detailed view of selected key analyses we perform:

Revenue Concentration

To check the business model viability of a SaaS business it is important to check whether a significant part of their recurring revenue comes from a few big customers.

This is also quite important to take into account while performing customer churn analysis. Indeed, if the company has one historical client representing 40% of their revenue, two things need to be kept in mind

How likely is that customer to remain loyal, especially after a change of ownership?

1.

Is the churn rate calculated on a MRR which includes this customer? If so there is a real risk of global retention rate to be overstated.

2.

Customer Lifetime Value (CLTV)

The customer lifetime value analysis seeks to estimate how much revenue on average will be generated from a customer before they churn.

This number is particularly important with Software as a Service and recurring subscription software businesses because as a general rule, after investing in software development and customer acquisition, the amount of costs to deliver the service to the customer is generally very low.

Of course depending on the type of product, quality of the software and the UX, customer support required may be more or less important to ensure customer success and customer satisfaction.

We then need to understand the average revenue generated per customer, based on customer type or product, understand the revenue generation profile (e.g. is there a ramp-up period where customer will generate 3x more revenue in year 3 than in year 1?), and spot any change in customer behavior in the more recent months.

Cohort Analysis

Cohort analysis is one of the most insightful ways you can analyse a SaaS business revenue.

By looking at average revenue per user, LTV, Customer acquisition cost and churn based on customer’s date of onboarding and tracked over time, you will build a strong understanding of how customers behave and be able to spot any change in average behavior over time.

For example, you can chart the average retention pattern of customers over time by year of onboarding to understand whether management has been successful in reducing the churn, or to spot any change in customer behaviour following a significant macroeconomic event.

Current Year Trading

Current year trading is the analysis that consists in focusing on the months of the current financial year and to assess how they compare to previous years and whether Management is on track to achieve their yearly budget.

Depending on the seasonality of revenue and expense, it may also be interesting to calculate a run rate revenue and EBITDA to compare to previous full years.

Pipeline Analysis

Pipeline analysis is mostly valuable for enterprise SaaS companies with long sales cycles.

Looking at the pipeline at the latest date but also at historical pipeline allows to form a view on average conversion rate from lead to sale and to give a view of how much of the current year budget is secured or almost secured by the current ongoing conversations.

This also gives the investor a view of how much revenue will need to be generated from leads that are still not in the pipeline at the time of the transaction.

FDD

Report

The report will obviously be read by the potential buyer, but it may be shared to other parties. Here is a quick overview of who can use a FDD report and how they would use it.

Buyer, to prepare their own forecast and refine their valuation of a Target company.

Board of directors to agree on the details of a Transaction

Banks, to agree on a certain amount of financing

A FDD report by trusted advisors may also weight in the negotiations by providing an expert eye on technical points

HoriZen Team

Structure

Typical FDD Report Structure

Next Steps

to Kick-off

Do you still have questions on how to effectively approach your deal and your transaction?

We always welcome a request for a call. If you’d like to speak directly with us, please feel free to book a time with Pierre-Alexandre Heurtebize at your earliest convenience.

Pierre is a director at HoriZen Transaction and M&A services, ex-Transaction Service consultant at PwC, EKEM Partners community fellow and creator of the Financial Due Diligence online course and regularly writes technical articles published on specialised websites like Techcrunch or Toptal.

You can read his Techcrunch article on Quality of earnings or his article on how to prepare a cash flow statement.