SaaS Valuations: How to Value a SaaS Business in 2023

03/09/2020

M&A: Managing The Sale Process

04/23/2020Whether you be an entrepreneur looking for how to sell a business, an investor researching how to buy and value a business an accountant or a scholar interested in the topic of merger & acquisitions, this article will provide an approach on how to valuate a company. We will break down our methodology in 5 key steps.

Step 1 : Understand The Business

The first step in how to value a business is to understand it in depth. Not only do you need understand the product or the service sold, but also the overall operations.

Who are the customers? Who are the suppliers? What is the geography covered by operations? How well is logistic handled?

Before putting a price on a business you have to assess how attractive you believe that business from a lender or potential buyers perspective. Start by gathering and reviewing the operational metrics, talk to the management team and do not refrain from asking questions or do additional research from the team. To assist you in this task, you can use some well-known frameworks used by the best strategy consulting firms such as the McKinsey frameworks.

Experience in the Specific Industry the Company Operates

At HoriZen Capital we capitalize on our in-depth knowledge of SaaS businesses, whether it’s online B2B or B2C software, and our advanced understanding of SaaS metrics to source the best assets to buy. In particular, being extremely familiar with the Software as a Service industry, we know the importance of reviewing key metrics such as churn rate, customer acquisition cost, customer lifetime value or historical lead conversion rate and their implication on our capacity to improve and grow the businesses we invest in.

You also need to understand how you will fit in the business, or how the business will fit in your existing operations. If you already have a complementary business and are looking at acquiring a new one, how much value do you think this acquisition will bring to you? The value of a business is not intrinsic; it is dependant on the buyer existing assets and strategy. When you’re trying to understand how to valuate a business, start by assessing the quality of its operations and the potential synergies a buyer could benefit from.

Lastly, you will need to assess the current management. Are you a financial investor looking to invest in a company with an existing management team grow it for you? You’d better make sure that an ‘A’ team is steering the business success and that top executives will be willing to continue post acquisition. Implementing an earn-out structure and incentive plans will help keeping them on board and motivated.

Step 2 : Understand the Market

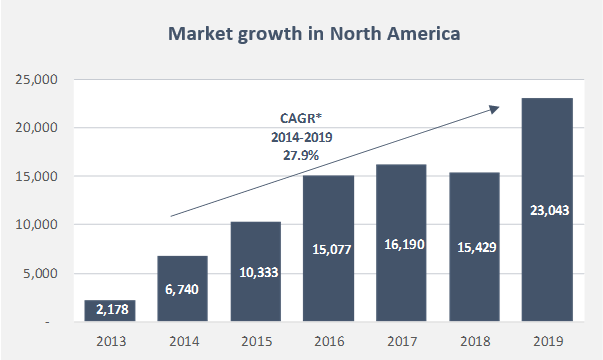

Once you have understood the business and its operations, look at the environment the business is operating in. How huge is the existing addressable market? Is the addressable market growing or shrinking? How competitive is it? Is the market hard to enter? Is the market driven by innovation or old school? All these questions should help you estimate the potential upside and growth of the company going forward, but also the recurring investment required to operate the business, be it in marketing or in R&D.

When you are assessing and valuing a business you want to make sure you understand the past but you also want to be looking forward to understand the growth perspective of the company and how difficult it will likely be to achieve that growth.

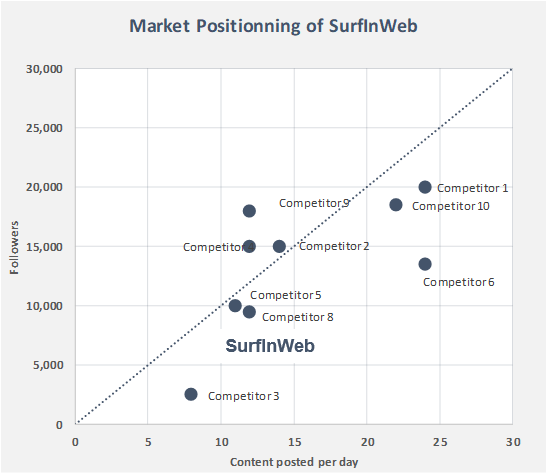

Not only do you need to understand the dynamics of the market, you also have to do your research on how it is divided between competitors. Are a few of them clearly dominating or is the market fragmented? Is your strategy to compete with the big guys or to grow the company until it gets acquired? Are your competitors already everywhere or can you easily operate in low competition geographical areas?

Step 3 : Understand the Competition

Now that you know the competition from a macro perspective, start digging and understand what your competitors do and how they do it. Go on their website, check their ads, try to find analyses and reports. How is competition’s product or service different from the business you are trying to value? Does it bring more value to the customer? Is it cheaper, more expensive? Does the business hold a patented technology that gives it an edge over competitors?

To help you value a business, look at comparable operational metrics from competitors. What are competitors’ prices, margins, revenue growth, net profit margin? How do they compare to the business you are currently valuing? This information may be harder to find when most of competitors are privately owned companies which generally keep this kind of information secret.

You can also try to find some data in blog posts, interviews or specialised databases like Owler, Merger Market or Pitchbook to name a few, or if you are well connected in the industry, try to reach out to your contacts who may be knowledgeable in the area. You can also have a look at consulting firms public reports and articles (strategy consulting firms, big four accounting firms etc.) that can provide invaluable insights and averages metrics on specific industries.

Step 4 : Understand the Financials

This will evidently be a key part of assessing the value a of business. Financial analysis will teach you a lot on how the business is tracking and its potential to deliver growth and profit in the future. Start by understanding accounting principles like revenue recognition and inventory principles, which can have a significant impact on how the information is presented. Understand the trends, the profitability, break down your analyses by relevant categories, be it by geography, by customer or by channel. Make sure that you are comfortable with the financial robustness of the company you are assessing and if you can see proof that management forecast are reliable.

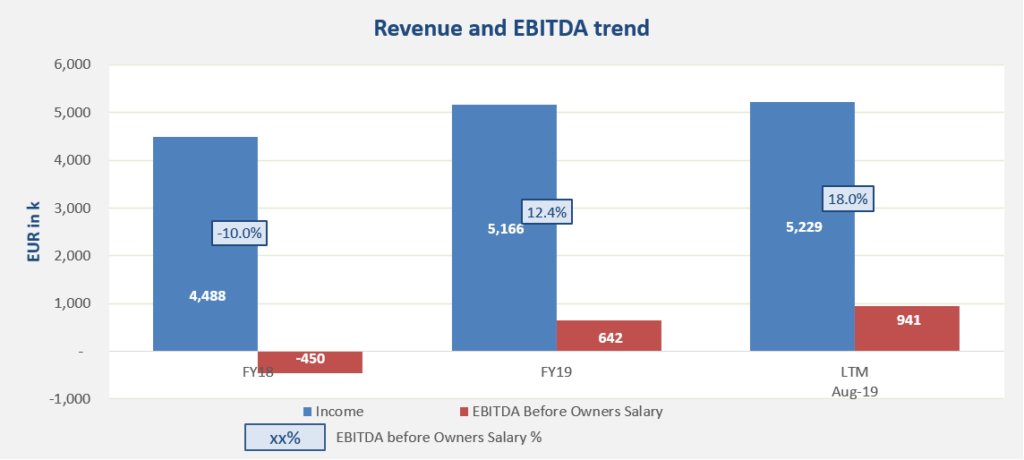

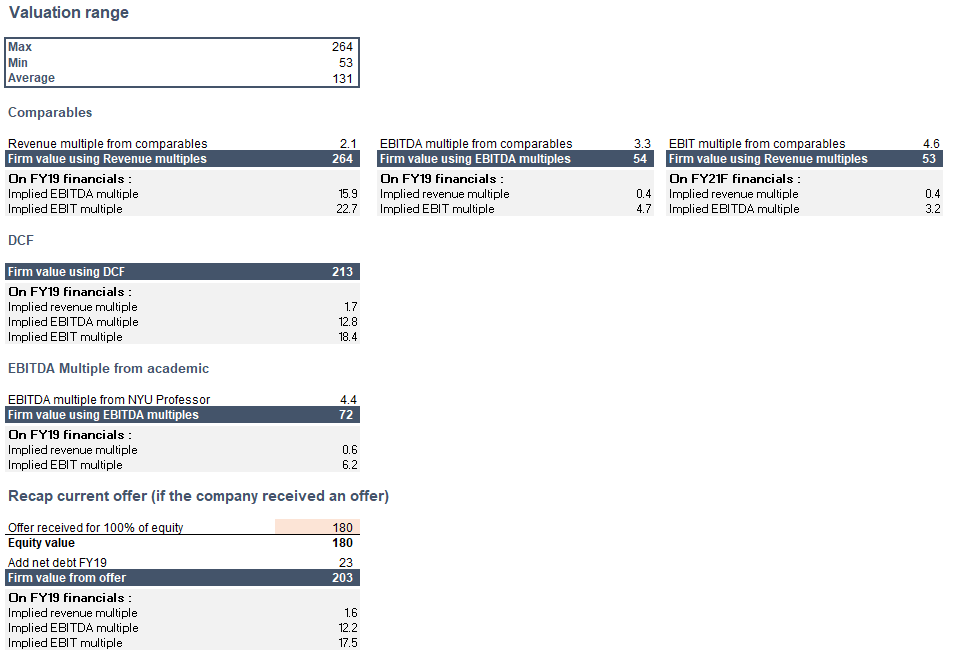

A key point in looking at financials Is to understand cash generation and adjusted EBITDA, or seller’s discretionary earnings (SDE). A fair number of businesses are valued based on an EBITDA, revenue (see: how to value a SaaS Business) or SDE multiple and a buyer and a seller will generally want to negotiate adjustments to EBITDA or SDE, arguing that some events may not be representative of the business operation going forward, or that the positive impact of recent measures are not yet reflected in reported numbers and that valuation should be done on a Pro forma basis.

Step 5 : Understand Valuation Multiples

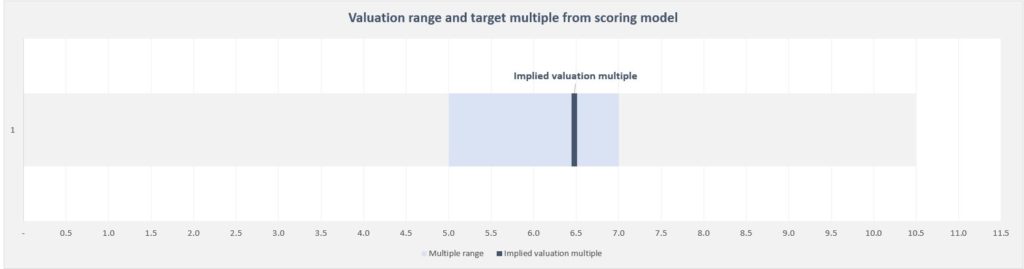

To become better at how to value a business, we highly recommend that you use several valuation techniques, the most common being Discounted Cash Flow and multiple-based valuation. Please refer to this video for a short explanation on how to build a DCF valuation. This will allow you to come up with a valuation range instead of a hard, definitive number, and help you set up your expectation and negotiation. You can also review the following video of an existing valuation model which walks you through a DCF template. You can see an output example below:

Look online for similar companies that have recently been acquired or which have raised funds. You can generally find information on the value paid by investors and recoup information from different sources to come up with a Revenue multiple or an EBITDA multiple paid for the company. You can then compare the acquired companies to the business you are trying to valuate, comparing all the elements you were able to find (size, revenue growth, profitability etc.)

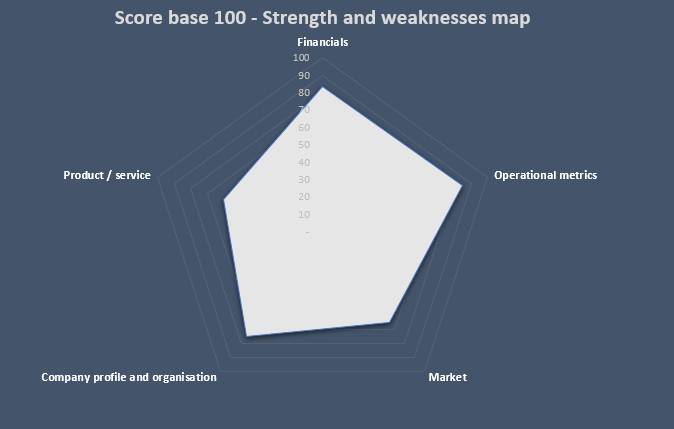

Another process that we use at HoriZen Capital to help us narrow down the multiple and value a business is we want to use is to put together a scorecard to rate the business. At this stage the assessment you’ve made by collecting information following our indication in sections 1 to 4 will come into play. You can use what you think are the key drivers of the business and use them to come up with a grading system that will help you set the cursor on the multiple to use. You can check out this scorecard valuation model video to have a good idea of how to do this analysis.

To Best Value a Business, You Need to Know The Fundamentals and Environment

What we have tried to described in this article are the different elements you want to analyze, understand and integrate into your valuation of the business.

If you would like to go further and better understand the technical aspect of how to value a business and a broader range of methodologies of how to valuate a company you can have, FitSmallBusiness walks you through different valuation techniques to self-assess the value of a business.

However, whatever your assessment and your belief may be, whatever your technical background or you financial acumen, always remember that the price of a business always ends up being a price agreement between a buyer and a seller.

First, make up your own mind on how much you think a business is worth. But then, confront it to the reality of the market and learn to revise your opinion based on the feedback and offers you get.