Why Choose a SaaS Provider vs Traditional Software Every Single Time

09/17/2020

Top 10 Challenges SaaS Companies Faced in 2020 (Expert Roundup)

02/20/2021How to Write an Investor-Ready Startup Pitch Deck

How to Write an Investor-Ready Startup Pitch Deck

A pitch deck, also known as a start-up or investor pitch deck, is a presentation that helps potential investors learn more about your startup business. As strange as it sounds, the primary goal of a pitch desk is not to secure funding—it’s to make it to the next meeting.

When writing an investor pitch deck, focus more on what a potential investor wants to read rather than what you want to write. Chances are, if you are a founder, you are super passionate about your startup business (which you should be if you want to fundraise) and you have thousands of things to say. You’ll likely be inclined to share all the great stories you’ve had, all the ideas that are on your roadmap and everything positive you can think of when it comes to your business. Investors love the passion, but too much information can be quite overwhelming, especially if it focuses on areas investors are not really interested in, at least not at this stage.

One of the key realities to understand is that investors and potential buyers go through several phases when assessing an opportunity. Think about it as a funnel. In all truth a professional investor will receive dozens of pitch deck presentation a week. What they will look for during a first review is whether the opportunity fits her investment criteria from a high-level perspective. If that box is ticked, then investors will want to dive a step deeper and generally look at financials in more details. If they’re happy, they will dive even further and step by step make sure they get a full grasp of the business.

To improve how your investor deck is received, make your best effort to help that thought process. For instance, don’t try to go through all the technical details of your product in your pitch deck. It’s great to have these details and be ready to provide upon request, but keep them on the side for now. They’ll come handy once investors are comfortable with the high-level view of your startup and ready to deep dive into more complex subjects. po

A good startup pitch deck goal goes beyond simply presenting a company’s product. A pitch deck should fulfill the following expectations:

• From an investor’s perspective, the slide deck should give a clear and concise understanding of the business model, its operations, its market, its strategy and its financials

• From a startup entrepreneur perspective a pitch deck should articulate the story of the company in its best light and fully demonstrate the growth or potential value of the company

• A pitch deck should also be able to answer the main questions an investor or buyer would naturally ask. Since most M&A or fundraising processes will involve several potential buyers and investors, each question that is not answered in an Information Memorandum(IM) will need to be addressed multiple times and can become quite cumbersome for a funder. A good solution to keep the messaging in a pitch deck straight to the point while providing answers to investors is to have a data pack and Q&A file prepared in to a Data Room on the side that you can easily share on request.

In short, a startup pitch deck should be a visual document aimed at grasping the attention of potential investors and providing them enough data to make them understand your business model and the strong potential of your startup.

Pitch decks will be different depending on who you target and what your objective is. The presentation slides will be different whether you try to raise equity, sell the company, try to raise funding from a Venture Capitalist, an angel investor, a PE or a bank, the stage at which you are at and the number of people you intend to share it with etc.

Keeping that in mind, as we will walk you through a general startup pitch deck structure that we like to use for startups and SMBs. There is no one fits all approach and several ways to achieve a killer pitch deck so feel free to use it more as a framework and twist it to fit your own target market.

1

PART 1

Introduction

The introduction part of the presentation deck should be just 2-3 slides long and

gives a high level description of the business along with key numbers

you’d like the investor to have in mind. Personally, I prefer to keep it

to two slides if possible and use the following structure:

1

Summarized Overview of the Company

Visual slide with a tag line or short description of the company, similar to what is commonly found on company’s Linkedin or social media page. Think about it almost as an elevator pitch, you have 15 seconds to let someone who you’ve just met know what your company does, what would you say to that person?

Some examples of good LinkedIn catchlines that could be used in a great pitch deck introduction:

“For forward thinking recurring revenue businesses who value growth, ProfitWell provides industry standard BI solutions that improve your retention and monetization automatically through unmatched subscription intelligence. ProfitWell serves over five thousand subscription companies, including B2B companies like Autodesk, Atlassian, and Zuora, and B2C darlings like Meetup, Blue Bottle Coffee, and Lyft.”

“Swrve is the only enterprise-grade marketing and customer engagement platform on the market that enables brands to connect with their customers with relevant messages, in real time, and at scale. By combining messaging across channels like push, in-app messaging, web push, email, SMS, and OTT with real-time data streaming, marketers can leverage real-time relevance to make a real impact their bottom line.”

“Helpshift is a mobile-first customer service platform. It delivers a great in-app help experience for many of the world’s top mobile apps and mobile games. Whenever users need help they can get it right in the app with an always-on help experience that delivers immediate, automated solutions to many issues. Companies such as Zynga, Microsoft, Viacom, and hundreds of other leading brands use the Helpshift platform to provide messaging-first customer support. Helpshift is installed on two billion devices worldwide and serves more than 820 million active consumers monthly. To learn more about Helpshift, visit helpshift.com and follow @helpshift on Twitter.”

On top of the tag line, add 5 or 6 key point and numbers presented visually to help the reader understand how big your company is and how successfully you’ve been. For a SaaS company for instance, you could show:

- Annual Recurring Revenue (ARR): because an investor or a buyer will want to understand how much revenue the company is generating. Most Venture Capital firms have a certain range of company size they are targeting, meaning that they won’t even consider investing if the ARR is below their floor threshold or above their ceiling threshold. Providing this number upfront will help them easily know whether or not it makes sense for them to continue reading.

- Growth Rate: because investors want to understand if the business has been growing and how fast. Growth rate generally has a huge impact on valuation, especially with SaaS businesses, and some investors like Venture Capitalists specialize in high growth start-ups with high revenue multiple for the valuation while other investors will focus on slower growth companies with more reasonable valuation multiples.

- Churn Rate: is a very important measure for SaaS company and will tell investors how hard Management needs to work and how many new customers they need to bring per year just to compensate the loss of existing customers. Churn rate can be a very good proxy to understand how happy customers are with the product, how competitive is the market opportunity (ie. lot of competitors means that clients have more risks to switch to another provider) and the general buying pattern on the market (eg. is this a product that people inherently use for just a couple of months or is it a platform happy customers stick to for a long time)

- Customer Lifetime Value (or LTV/ CLTV): that gives how much revenue on average will be generated per customer over the time the customer will stick with you. This number is particularly interesting to an investor in SaaS businesses because it gives a good indication of how much the company can afford to spend on customer acquisition while still being profitable. A higher LTV generally means more latitude for a buyer to come in and invest in digital marketing and sales to accelerate the growth of the top line.

- Number of Employees / Contractors: allows the investor to approximate the cost of running the business, especially with SaaS businesses where employees are generally the main source of costs. It will also give a high-level view of how efficient the operations are and how scalable the company is (ie. a $2m ARR revenue with only 10 employees is likely a lot more profitable, efficiently run and scalable than a $3m ARR company with 35 employees)

- Company Founding Date: gives a sense of how many years the company took to reach its current ARR, but this will also tell the investor how many years the company has managed to stay in business. While a company with a long history may not be a good sign for VCs who are targeting super growth companies and can see it as a sign that the market is not growing as fast as expected, for more risk-averse investors looking to invest or buy-out more stable businesses, a long history of revenue generation is generally a good sign to reduce the risk factor to see the company go bankrupt.

An example of an introductory slide that we use at HoriZen is presented below:

Startup Pitch Deck – Company Overview

2

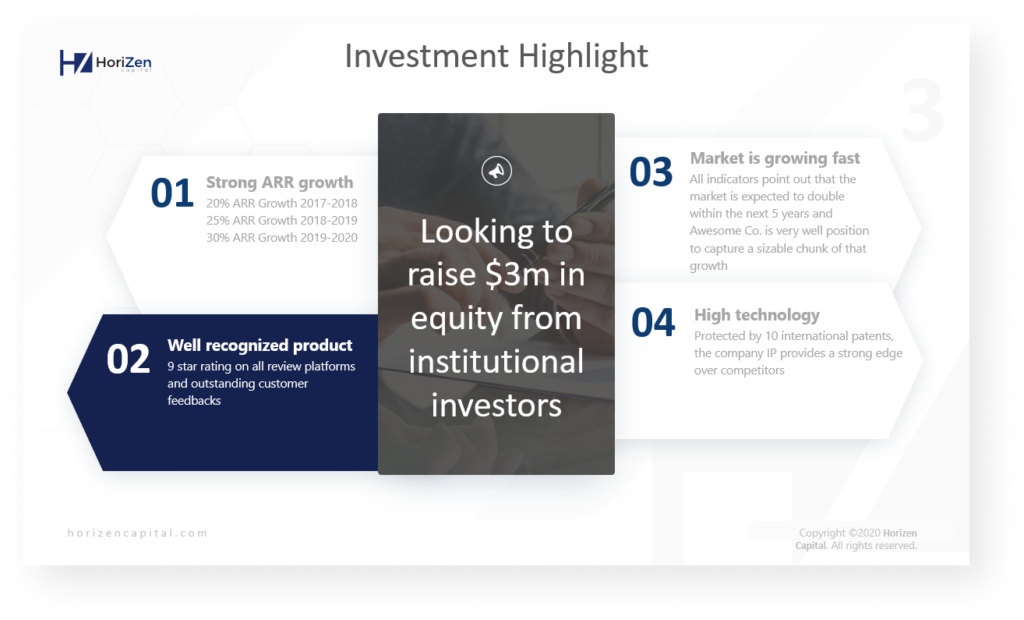

Key Acquisition / Investment Highlights

On the second slide of the introduction, I would advise to let the reader know what you are looking for. Don’t make them have to scroll all the way down to understand why they are currently reading this pitch deck; this would only create frustration.

For instance, if you are looking to raise startup funding, indicate how much you are looking for. If you want to sell a take in your company and you have a clear idea how much % of ownership you would like to sell and provide clear indication. If you are looking for a very specific type of buyer (eg. a strategic buyer who can integrate your product to their offering), be as clear as possible.

This slide is also a good way to summarize the main reasons why you think this is a very good investment for the reader. Narrow down the key takeaway points around why you believe your company is top notch and would bring a lot of value to an investor, and highlight these points here.

Some examples of attractive selling points include :

Dominant player on the market

5 years of consistent accelerating growth

Exclusive partner of RedBull

Very high retention rate (98%+)

State of the art technology

Limited competitors and high barrier to entry

Providing a ROI of 40% to clients within 6 months of using the product

Super lean operation and highly scalable model

$3MM of pre-orders outstanding

65% EBITDA margin a

Low Capex, high cash flow generation

98% customer satisfaction with the product

Pick you most attractive selling points and showcase them in the introduction to make sure the investor have them in mind from the start!

An example of such a slide is presented below:

Startup Pitch Deck – Key Acquisition Highlights

2

PART 2

Business and Product Overview / Presentation

Now that you’ve put together a nice introduction and that the investor understands the context around the transaction, make sure they understand what you are selling, how you are selling it and to whom. People, and professional investors in particular, do not like to invest their money in things they do not understand. Being clear in presenting what the company does really helps build confidence and helps the investor make an educated decision. It also demonstrates your capacity to present your product well, which is generally a good indicator of how well you will be at selling the product to customers!

3

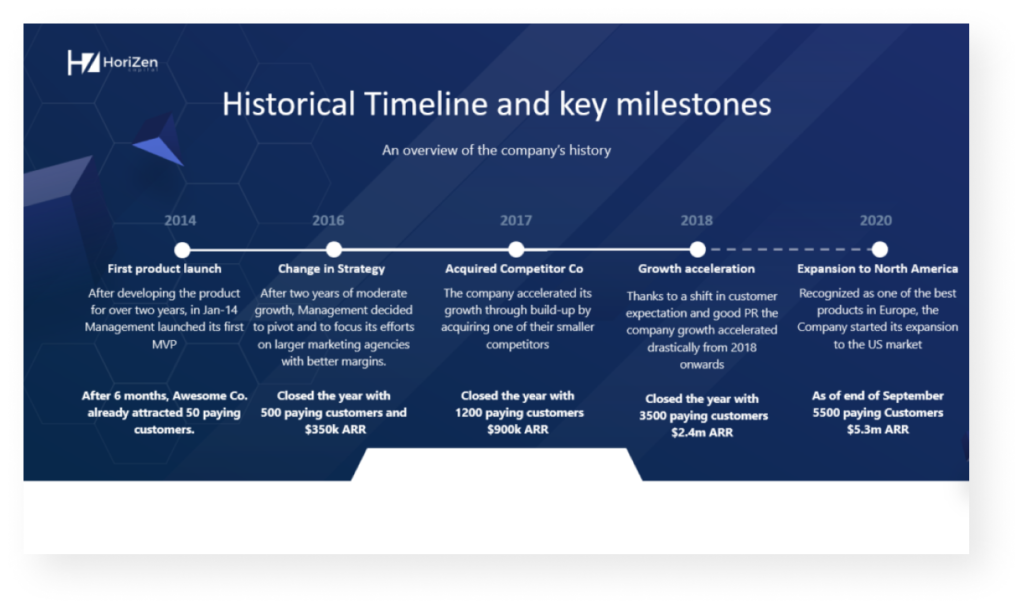

Historical Timeline and Key Milestones

Investors like to understand the background and main historical milestones of a company. It gives them more context and help them towards understanding the trajectory of the business, past obstacles and how the company has developed up to this point, whether management had to pivot at some point and when and how fast market adoption was reached.

Key milestones will generally be very specific to your own business, but classic ones we encounter in a successful pitch deck are as follows:

- Launched beta version

- First 10 paying customers

- Launched new pricing plans

- Reached $1MM in annual recurring revenue

- Company was featured on Forbes top 10 product of the year

- Switched focus from SMBs to enterprise customers

- Company merged with a competitor

- Ex top-5 of Google join the team as CTO and Head of Strategy

And example of a historical timeline and key milestone slide is presented below :

Startup Pitch Deck – Historical Timeline

4

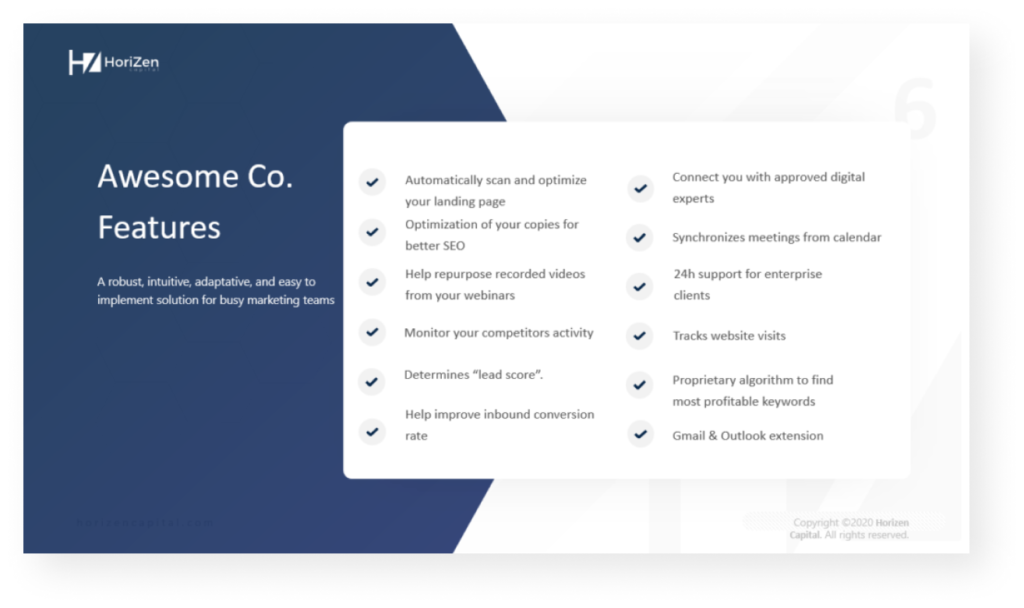

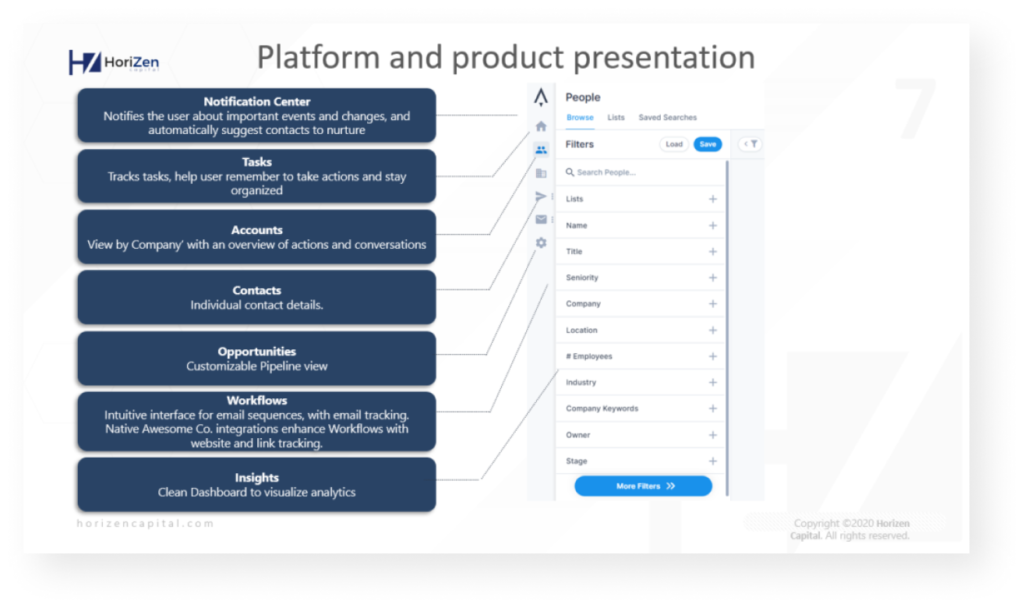

Product Features / Walkthrough of the Product

The idea here is for the investor to understand the core of what he is going to be investing in: the product. For bigger companies with a wide range of products this section can become more complex to summarize. However, for startups and SMB businesses it can generally be described in just a few of slides.

Avoid being over technical or to get into too much details!

Also, try presenting the product like you would do to a potential client. For a SaaS business, a screenshot of the platform with explanatory callouts for instance can be a good way to quickly gain a fair understanding of what the product is and does. You can also include a link to a quick demo video (no more than 3 mins long), but we would recommend to make sure that the pitch presentation of the main products and key features are shown directly in the slide as a reader may not put the extra effort to click on an external link.

In short, these presentation slides should help your reader feel like he knows your platform even if he has never been on your website. As a general rule, prepare a winning pitch deck as if this was the only thing the investor will look like before deciding whether to explore further or not.

Startup Pitch Deck – Historical Timeline

Startup Pitch Deck – Features Presentation

Startup Pitch Deck – Historical Timeline

Startup Pitch Deck – Platform overview

5

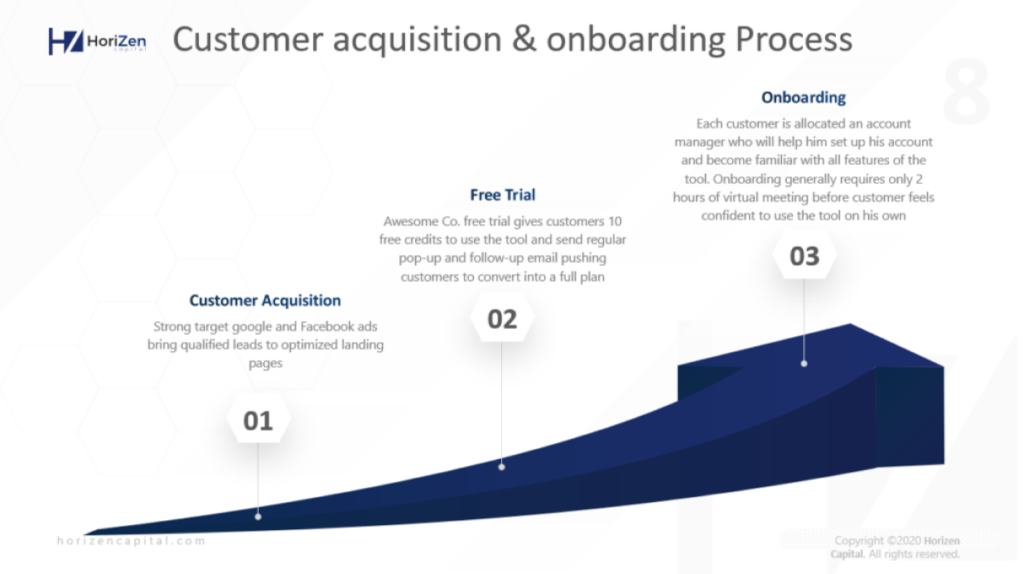

Customers Acquisition Channels / Onboarding

At this stage of your startup pitch deck, the investor understands your product. Now what they would like to understand is how you acquire customers and what the onboarding process is like.

In this section you do not have to detail actual numbers around the operational metrics and conversion rate which we like to keep in the “financials and operation metrics” part. Rather focus on detailing the strategy to generate leads, the different steps of your sales process and what is required to onboard your customers.

An important thing to understand is that investors like when things are organized, and when processes are in place that can be replicated and scaled. The scalability of a business is one of the key aspects an investor will look for. In other words, an investor ideally would seek to invest in a machine whose engine is ready and where the money he invests into the company is just the fuel to make the company grow faster.

Realistically, the reality is of course more nuanced and complex than that. However the more you can demonstrate that what you are doing is rationalized and follows a replicable protocol, the better it will reflect on your team and company and the higher chance you will have to gain investor’s trust and attract a nice check.

A simplified, visual example of a pitch deck design slide describing an onboarding process for a SaaS company is shown below :

Startup Pitch Deck – Customer Acquisition & Onboarding Process

6

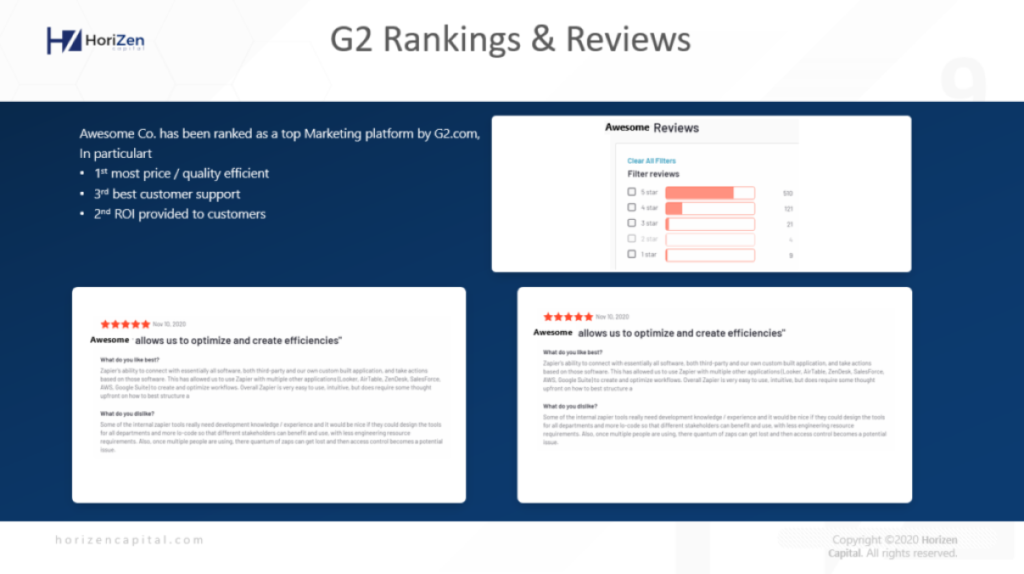

Testimonials, Reviews or Screenshots to Prove Quality of Product

At this stage of your startup pitch deck, the investor understands your product. Now what they would like to understand is how you acquire customers and what the onboarding process is like.

In this section you do not have to detail actual numbers around the operational metrics and conversion rate which we like to keep in the “financials and operation metrics” part. Rather focus on detailing the strategy to generate leads, the different steps of your sales process and what is required to onboard your customers.

An important thing to understand is that investors like when things are organized, and when processes are in place that can be replicated and scaled. The scalability of a business is one of the key aspects an investor will look for. In other words, an investor ideally would seek to invest in a machine whose engine is ready and where the money he invests into the company is just the fuel to make the company grow faster.

Realistically, the reality is of course more nuanced and complex than that. However the more you can demonstrate that what you are doing is rationalized and follows a replicable protocol, the better it will reflect on your team and company and the higher chance you will have to gain investor’s trust and attract a nice check.

A suggested way to present such a slide is included below. (Discreetly used Zapier’s reviews and surreptitiously changed the title name to Awesome Co. with my highly advanced Photoshop skills)

Startup Pitch Deck – Customer Testimonials

7

Presentation of Founders, Background and Role

The team slide part of the pitch deck is extremely important if you are looking to raise Venture Capital funding or seed funding as opposed to exit the business. Investors like a Venture Capitalist or Private Equity firms generally rank the quality of the management team as the number one reason why they decided to invest in a business.

Walk them through your background, what you have achieved in the past but also what you have tried, failed at, and what lessons you draw from these past experiences. Of course, investors will need to interact with you to assess your skills but a great first introduction on paper will help setting up their expectations.

If you are trying to exit the business, I would say that you don’t need as much emphasis on your background, rather a buyer would want to understand your role, how much time you spend on the business and how critical you are in the day to day operations to the business. The approach is fundamentally different from a fundraise.

If I were to summarize the general investor logic, if you are raising capital, you should be seen as a Rockstar because you will be piloting the rocket. If you are exiting, you would actually benefit from being perceived as lacking fundamental skills that the new owner can hone and benefit from doing a better job than you!a

Here is an example of a light, visual slide to introduce founders that would be more suitable for founders looking to exit rather than fundraise.

Startup Pitch Deck – Founders Background

8

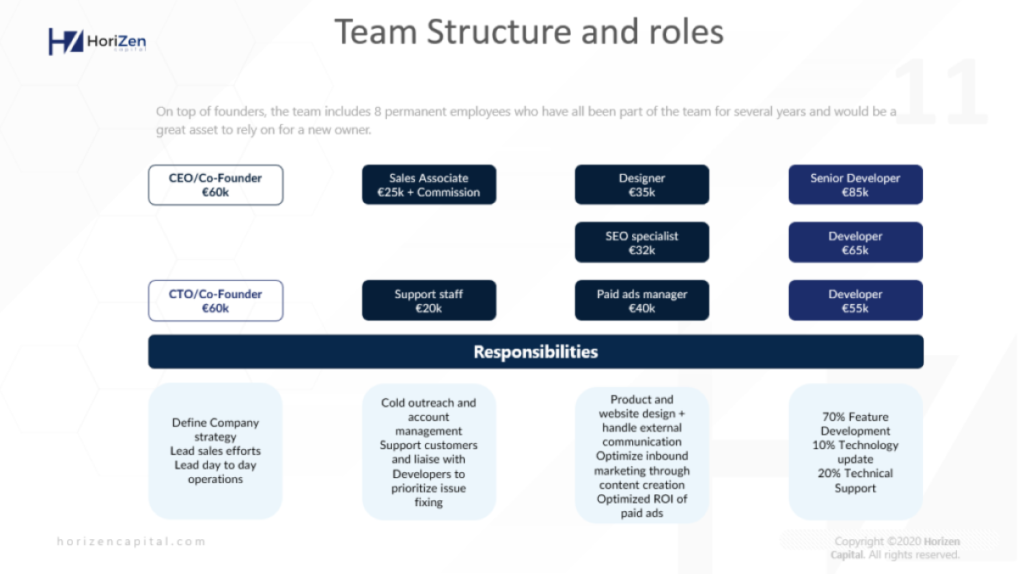

Team Org Chart and High-level View of Tasks and Responsibilities

When reading a good pitch deck, an investor wants to understand what he is buying into, and the team structure and skills is a big part of the strength of your organization. In this slide, indicate the number of Full Time Employees by job title, the overall hierarchy and a quick description of the role and task of each team member.

Another useful piece of information to include there, is the average annual salary, per job title. Understanding the employee cost structure and how much it would potentially cost to add a new team member will help investors understand your business better and assess your team structure vs. their own knowledge of the market. It can also be a good indication for the buyer on whether he thinks he can source cheaper labour and increase the profitability of the business.

Startup Pitch Deck – Team Structure and roles

Quick Recap

Let’s recap for a second. At this stage of your pitch deck, the reader should have a good understanding of:

- How you got to the point where you are at

- What product or services you offer

- How you acquire your customers

- What’s the process to onboard your customers

- What your customers think about your company and your services

- How strong the background of top management is

- What your team structure looks like

- Now it’s time for them to get a good grasp of the market you are operating on

9

Market Opportunity

This slide, as for the entrepreneur presentation section, will be very different depending on what startup funding stage you are targeting.

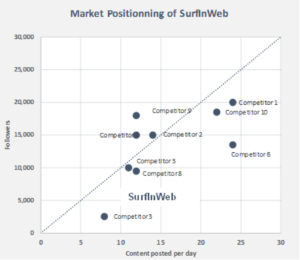

Targeting a Strategic Buyer

If you are looking to be acquired by a strategic buyer, it is likely that they already know the competitive landscape you are operating in very well. If this is the case, rather than spending time and effort running a classic market research, try to instead focus on showing how you are positioned on the market versus your competitors.

A good way to do that in a powerful pitch deck is to find two relevant attributes (eg. Price and number of features, or Ease of use and size of targeted customers etc.) and position yourself and your competitors on a chart based on these two attributes.

What you can also do is to demonstrate the M&A trends on your market to show that there are numerous competitors acquiring companies like yours for strategic reasons.

Example of Market positioning charts that you can do yourself on Excel:

Startup Pitch Deck – Market Positioning vs Competitors

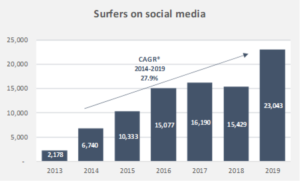

Combined with a simple chart demonstrating the growth of the market:

Startup Pitch Deck – Market Growth

Targeting a Financial Investor or Buyer

If you’re targeting VCs or entrepreneurs looking to takeover the management of the company, spend more time researching the market and give them clues that the market is growing and has huge potential. With these types of investors, do not hesitate to add more slides to the Market section.

Whether a market and competitive landscape is attractive or not is one of the top reasons, along with the quality of a team, for why a VC will proceed with an investment. And this is likely one of the first questions their investment committee will ask them. If you give them enough material and reliable sources demonstrating that your market is indeed growing pretty fast, you’ll have higher chances to take the conversation further.

One piece of advice that we generally give to SaaS founders is to make sure that you present your addressable market in a smart and sensible way. One of the most common complains that investors have while reviewing an investor pitch deck, and which undermine greatly the founders’ credibility, is the slide that boldly states “we are addressing a 150 billion dollar target market”. Chances are, you are not.

If you have created a product to optimize and automate email campaigns for instance, don’t state that the global digital advertising spend per year is XX billion and that this is your market. Do not either say that hundred of billions of emails are sent per months and that this represents your addressable market. Try to be smarter about it.

One tip to understand the logic about market sizing is to look at preparation of Strategy Consulting business cases, companies like BCG, Mckinsey or Bain (to quote only the top 3). The WetFeet guide for example is what I was personally using when as a MBA student I was preparing for interview with these firms.

The market sizing questions asked in the interview processes by top strategy firms will often be on very specific markets (eg. “how many golf balls are used each year in the USA”) but the underlying thought process to come up with a reasonable number is very valuable and can be applied to your own business.

Generally speaking, the Market section and the Business plan sections are the two parts of a pitch decks where investors may roll their eyes. Nobody expect you to have the exact number of $ spent on your market or to have 5 year forecast that are an exact prediction of what will happen to your business. However, you will benefit from demonstrating the potential of your market and business while showing you are a sensible person who can use reasonable assumptions.

Also, don’t be afraid to use the widely used market analysis templates available out there. SWOT analysis or the Porter’s 5 forces analysis, if done correctly, are still good ways to give a smart overview of your business to potential investors.

If you are interested in going further down the path of market research, both for the sake of putting together your perfect pitch deck but also to help you better understand your market from an operational and strategic perspective, you can have review these materials:

- This BadassConsultant article gives a fairly exhaustive list of how to approach market sizing and enumerates over 20 sources you can use to collect data or come up with reasonable estimates

- The internet is also full of Powerpoint templates that you can buy, download for free, or just use for inspiration and replicate. One of these template platforms is Slideteam that can help you get ideas on how to direct your research and present your findings

10

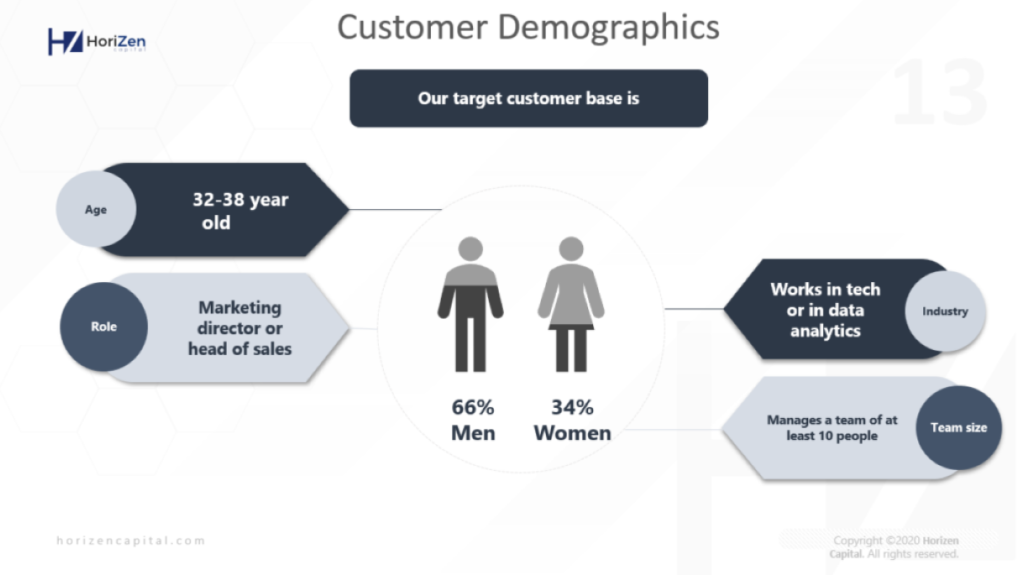

Customers / Target Audience

Now that the investor understands the market you operate on, you want to present the precise typology of your customers and targeted audience (which may be two different things). Defining precisely your customers / target audience demographics can also help in doing a market sizing

By presenting the target audience or customers you help the investor understand how you see the market you are addressing and to whom you target your message and marketing. Examples of targeted audience may be:

- Young adults in their mid-20’s to early 30’s, with a master degree and a Corporate job earning over $75k/year

- Marketing Director or Head of Sales at companies with at least 200 employees

- Independent real estate agents in second tier cities

This can help investor challenge the current strategy and offer alternative segments to target, ask management more meaningful questions and also assess based on their own experience the difficulty of the sales process based on the demographics targeted.

Examples of how to present the buyer persona in a visual way are included below :

Startup Pitch Deck – Customer Demographics

Don’t be afraid to have slides with minimal information if you want to highlight a particular metric or data point. As a general rule, we strongly believe that several well designed, easy to read slides are always better than one compact slide with all information piled up. For example the slide below is straight to the point and gives reader valuable information about the current customer base of the company.

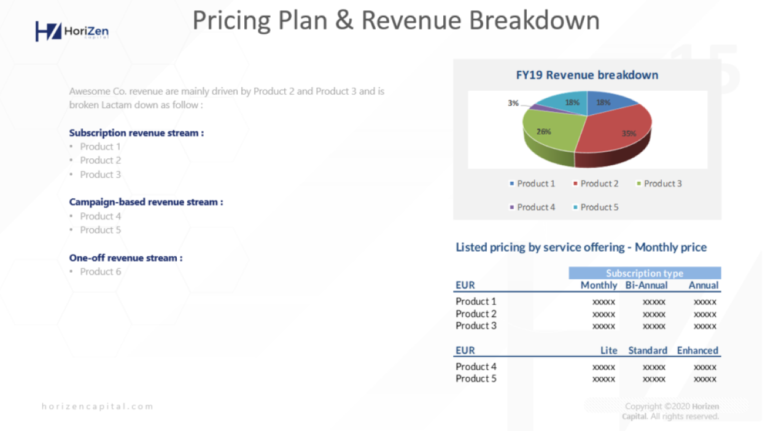

Startup Pitch Deck – Revenue Breakdown

11

Pricing Plan and Invoicing

In simple terms, what price do you charge your customers? Pricing strategy is one of the key challenges a startup founder has to deal with, and a lot of different pricing models can exist for the same product or service. Will the customer be charged based on usage? Based on number of users/seats? Will it be charged on a flat monthly subscription basis? Charged on a monthly or on an annual basis? Charged upfront or after the service has been provided?

All these factors have an impact on cash flow management, scalability, net working capital and on how the investor will have to analyze the historical financials of the business. Investors may also have a strong opinion on the type of business model that you have chosen to adopt. For instance, some experts will love to implement a freemium model while other will never advise to go beyond offering a free trial period to testing out the product.

Understanding your pricing structure also helps the investor request and understand specific operational metrics. In the case of SaaS businesses, if there are three several pricing plan available, it will be insightful to look at churn rate and growth, broken down by pricing plan.

Looking at pricing plans are also a good way for an investor or a buyer familiar with the space to assess if there is an opportunity to improve the top line and / or the bottom line of a business by changing the pricing strategy. A common example of that would be to acquire a SaaS business with only one flat pricing plan and implement post-sale a basic, premium and enterprise plan and to structure additional features to upsell existing customers.

Analyzing pricing from an investor perspective can also help uncover some inconsistency or sub-effective practices implemented by the seller. Based on our experience, we have seen SaaS companies with customers signing up for a monthly plan and cancelling the next month simply because it was cheaper for them to do so than to access the service on a one-time basis, rather then seeing the recurring value of the product.

The logic behind having just the right message for investors is even more an art than a science in the case of fundraising simply because you want to show that you are doing the right things and that you are on the right track, but you also want to show that there is room for improvement that you have identified and that the investor will benefit from post-investment.

In the case of a business sale on the other hand, it may sometime be smarter to just lay out the data and let the potential buyer figure out where he can come in and have a positive impact.

To present your pricing plan, you can simply add a screenshot of your pricing plan presentation as shown on your website (which is quite commonly available for SaaS companies) and a few comments on the side if you want to pinpoint the main differences between each plan. See Airtable’s pricing plan below:

Startup Pitch Deck – Revenue Breakdown

Startup Pitch Deck – Pricing Plans

You can also prepare your slide to also include a quick breakdown of the revenue per type of pricing. This will give your reader an additional valuable information on the nature of your revenue.

An example of such structure is presented below:

Startup Pitch Deck – Pricing Plan and Revenue Breakdown

12

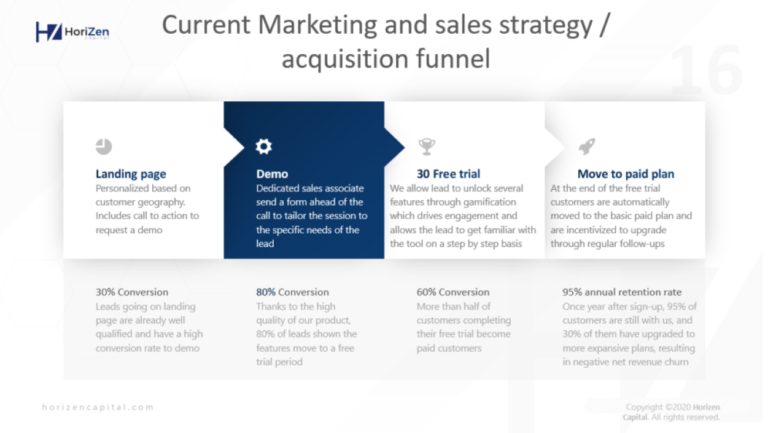

Current Marketing / Sales Funnel and Strategy

Anyone interested in your business wants to know how you sell it. Great ideas, fantastic products, amazing platforms are created every day. What often differentiates successful start-ups from failing businesses is how well you are able to find your market and sell sell and sell even more!

This section of your pitch deck will be fundamentally different based on the type of business you are running. Even between SaaS businesses, the sales process and funnel may be extremely diversified.

A B2C SaaS business will likely focus more on attracting visitors to their website and making sure they can convert into trial and paid customers without any human intervention. On the other end, an Enterprise focused SaaS company may have a much longer sales cycle which involves having several conversations with several points of contact within the same company.

Depending on your own context and situation, some ways you can build this section includes having a visual presentation of the step by step sales process ,with an indicative time estimation for each step.

eg. first contact => demo (1 week) => negotiation (2 weeks) => free trial period (1 month) => paid plan.

For a SaaS business, you can also present in this section the different channels that you use (eg. organic / SEO, paid advertising, webinars), and show for each of the channel the next steps of the lead journey before becoming a paid customer

Example :

- lead is sent to a landing page

- call to action for him to subscribe to the newsletter

- call to action for him to subscribe to the newsletter

- enter his credit card and is provided with a 1 month free trial

- receives an email 5 days before the end of the trial to give opportunity to cancel

An example of such a slide is presented below:

Startup Pitch Deck – Marketing and Sales Strategy

13

Benefit of Investing In / Acquiring the Company

Again, the orientation of the message in your pitch deck should be quite different if you are looking for someone to invest into your company or if as a founder you are trying to exit. If your goal is to bring in a financial partner, you want to show that you are on the right track and that all the pieces of the puzzle you are currently putting together will pay off soon. You want to demonstrate that you have a roadmap of things to improve and that you are the right person, with the right team to do it.

On the other end, if you are trying to sell your company and move on to your next project (or take some well-deserved time-off in the Bahamas), you want to set your ego aside and highlight the reasons why a new owner would be a better fit than you to run the business and realize all the potential that you could not realize on your own.

In other words, ideally you want to show that the business gets traction, that the product is good, that the code is clean and that it would be easy for a new owner to take over, however you recognize the areas in which you feel like you are lacking skills.

Some common benefits of investing or acquiring a company that often comes up in startup pitch decks include:

- Solid client base with longstanding relationships

- Product recognized for its quality and loved by customers

- Company’s revenue is ramping up

- Market is expanding

- Company is becoming very profitable

- Market is expanding Company is becoming very profitable

- Company has a very specific competitive advantage

- Attractive exit strategy (ie. strong M&A activity)

This is also where you want to clearly identify the potential improvement and upsell opportunities you see going forward. For instance:

- You can highlight that marketing expenses have been very limited and you believe that with more budget / more marketing skills and resources you could accelerate the growth

- You can point out that there exist sales and marketing funnels that you have never tested before and competitors are using successfully

- You can highlight that there is a potential to improve your cost base by recruiting qualified remote workers in cheaper countries or by moving the whole team on a remote basis and save on rent and travel expenses

- You can also point that you are not a pricing expert and that you feel that the pricing strategy could be much better optimized

A simple piece of advice for all the improvements you mention is to have a good reason not to have implemented them yet. For instance, personally when we review a pitch deck which claims that “we’re 30% cheaper than our competitors for the same quality, a new buyer can benefit from the upside to increase the price” my natural reaction is to ask why the current owner has not done so already since it seems so obvious. The reality is that there is always a risk to make changes to the price, and the low price may have been the main driver of the strong growth the company experienced.

In such a case, it may be smarter to be more subtle about it and only show a comparison with your competitor’s pricing and let potential buyer figure out that there is an opportunity that you did not even identified. Psychologically, people buy into an idea a lot more when it feels that the idea came from them.

A slide example is included below :

Startup Pitch Deck – Investment Benefits And Potential Improvements

14

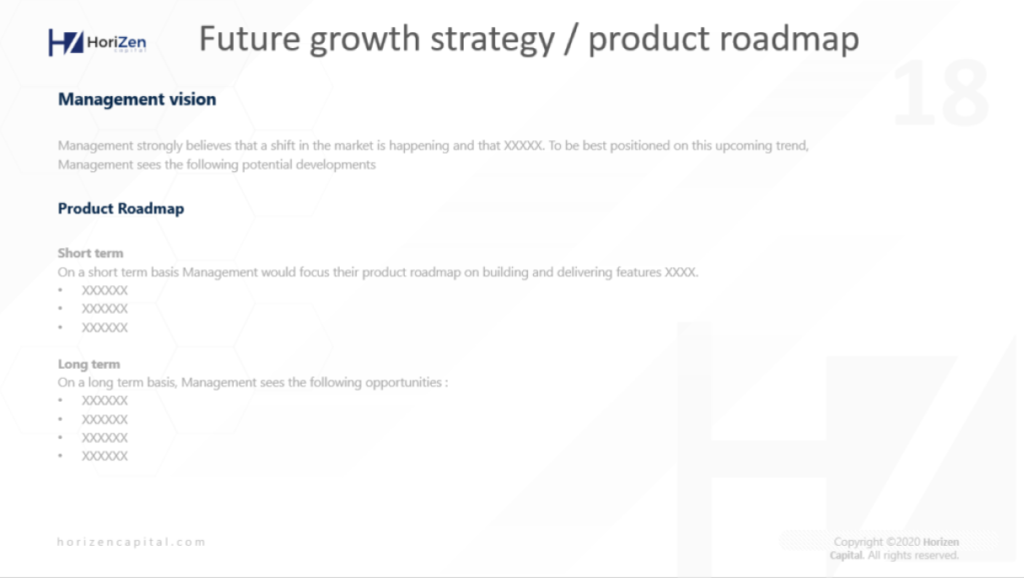

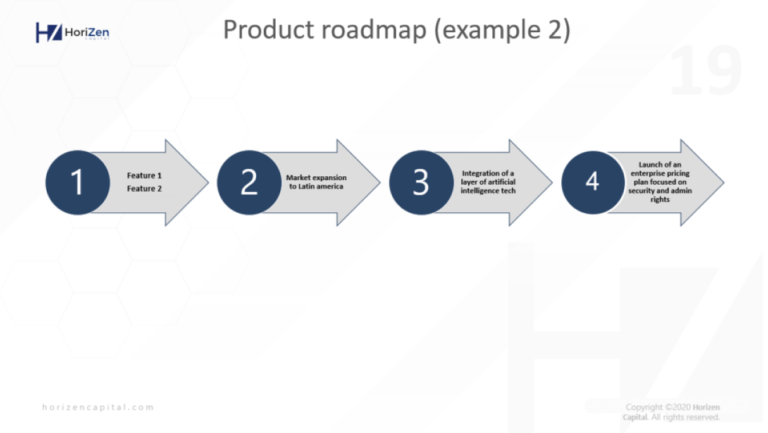

Future Growth Strategy / Roadmap

Now that your pitch deck has very well depicted your current situation, remember that a buyer or an investor likes strong historical results but really invests into the future potential of your company. After demonstrating that the basis of your business and the current trend are solid, fill up the reader on the future plan and where you see the business going.

If you are selling the business to a strategic buyer, you will need to put less efforts into this section since a strategic buyer will have her own agenda and her own way to use your product or your platform and to integrate it to her own offering with the existing value proposition. It’s still nice however to list the current development roadmap / additional features that you are currently working on.

However, if you are pitching to a financial investor, make sure to make a strong point in this section that you know where you are going, and that the future is bright!

For example, show your plan to expand to a new geography or a new demographics with high potential, showcase the new features that will allow you to upsell existing clients, advertise a partnership currently under negotiation that you think will bring a lot of upside to your top line. Show them that the current dynamics are good!

You can either keep a simple structure in the shape of bullet points, distinguishing the short-term and long-term strategy for instance, as per the following template slide:

Startup Pitch Deck – Future Growth Strategy and Product Roadmap

You can also use a pitch deck template for product roadmaps that you can find online to make it more visual.

You can also simply use the Powerpoint SmartArt graphics that can fully do the job as per the example below:

Startup Pitch Deck – Product Roadmap

3

PART 3

Financial and Operational Metrics

Up to this point of your startup pitch deck, you have focused all your effort on making sure that the reader understands your startup business. Any investor up to this point should be able to answer the following questions:

• What is the company looking for?

• What does the company do?

• How did Management/entrepreneur bring the company to where it is today?

• What are the main features of the product sold?

• Who are the customers and how are they acquired?

• How fast can a new customer be onboarded and how scalable is the business?

• How qualitative is the product based on customers feedback?

• How qualified are the team and founders?

• How are the roles distributed amongst the team?

• What is the state of the market? What are trends expected?

• What are the demographics of users?

• How does the company charge their customers and how do they generate revenue?

• How does the company attract and win new customers?

• What benefits are there to invest in or buy-out this company?

• What are the opportunities to improve the revenue and profitability of the business?

• What are the ongoing developments and future markets that the company plans to address?

I would recommend to use the above as a checklist against which to test your current pitch deck template. If you can check all the items on this list, your pitch deck is already in a pretty good shape!

Now that you have clearly laid out the nitty gritty of your business, it is time to get a bit geekier and talk numbers! Investors and buyers love to look at numbers because numbers can often speak better than words. They offer a clearer view of how the business is really trending and offers experienced investors and buyers objective comparison points to the types of companies they are used to invest in. In the Financial and Operation metrics section, you’ll want to make sure you present the key numbers that the investor expects to see.

Also, one thing that could not be stressed enough, ahead of putting together your pitch deck presentation, make sure that you know your numbers and that they are reliable.

Just to be more clear, I am going to say it again: make sure you understand every number in your pitch presentation, that you know how they are calculated and that the source for each of these numbers can be relied upon and ties to your other sources of data!

Presenting numbers that turn out to be erroneous or cannot be tied to audited financials or official reporting will damage your process in several ways.

It will create a certain frustration with the investor who has started to build an image of your business in his head and has made the effort to remember your key numbers. If these numbers turn out to be wrong, you create a need for extra mental effort to remodel her initial view.

On top of the above, it’s likely that if you are dealing with professional investors like Venture Capitalists or Private equity funds, the person who reviewed your pitch deck and decided to move forward did so after communicating key points and numbers to his team. Having your numbers corrected down the line means that they also have to justify the change on their end to their team.

It reflects badly on you as an owner or general manager. Investors generally strongly believe that no business can be successfully grown on the long term without strong reporting and accurate understanding of your numbers. A data-driven approach is widely accepted as one of the surest way to make the right decisions and failing to ensure the accuracy of the data may be seen as a weakness or lack of attention to details

It creates doubt in the mind of the investor, and doubt is the main thing you want to avoid. Even if one or two key numbers were wrong, then the loss of confidence and trust in the numbers presented spreads out to the whole presentation. On top of decreasing the probability of a successful deal, it will also make the process more cumbersome because a suspicious investor will naturally ask more questions and ask for more proof of the veracity of the data he is presented with

So without further due, let’s jump into the different section of the Financial and Operating metrics part!

15

Operational Metrics

To best prepare this section of your pitch deck, ask yourself two questions:

- What are the key metrics (KPI’s) that you keep a close eye on to manage your company?

- What are the operational metrics that demonstrate the efficiency of your company and operations?

Every industry has their own KPI’s and operational metrics, and keep in mind that a financial investor may not be fully familiar with these metrics but will likely pick it up fairly quickly. However, if they do have industry knowledge, they will use his previous experience to compare your metrics to the industry standard and judge how well you are performing and form an idea on what are potential areas for improvement.

Knowing your metrics and using them to manage your business is a great sign for an investor that you understand how your business works and what you should monitor to make efficient changes and take great decisions. If you are familiar with the TV show Shark Tank, where entrepreneurs pitch successful entrepreneurs turned billionaires and try to get them to invest in their venture, you’ll know how important it is for entrepreneurs to know their numbers by heart.

Some of the most recurring question in the Shark Tank show will include:

- “how much does it cost you to acquire a customer?”

- “what are your margins?”

- “how much do you sell it for and how much does it retail for?”

These are a very good representation of actual questions asked by investors in “real life” scenarios.

If you are pitching your SaaS business, some of the key metrics that an investor or buyer will like to see include:

- Year over year (YoY) Annual Recurring Revenue (ARR) growth

- Monthly Churn rate

- LTV (Lifetime Customer Value)

- CAC (Customer Acquisition Cost)

This section is also a good place to elaborate on your conversion rates.

For an internet business, classic conversion data that an investor wants to look at will include:

- Conversion from raw lead to demo

- Conversion from demo to paid plan

- Conversion from free trial to paid plan

- Average % of upsell per year

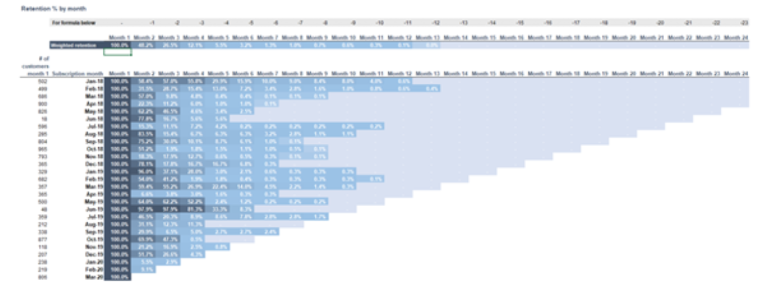

Depending on the data you have available and what areas you would like to highlight, you can elaborate on the analyses you present to give more flavour to the investor. For instance, a Cohort analysis for subscription-based business can give an additional understanding of the churn and retention pattern of your business and answers questions like “do customers churn in a linear way each month or do churn customers mostly leave in the first few months while retained customer become very sticky?”

You can also mention number of support tickets, % of inbounds leads vs outbound etc. In short, present the main metrics of your industry and add on top the metrics that you think make your business competitive and stand out.

A very simple example of key metrics presentation is presented below:

Startup Pitch Deck – Product Roadmap

A very simple example of key metrics presentation is presented below:

Startup Pitch Deck – Product Roadmap

If you are interested, you can download an excel model allowing you to do a cohort analysis by clicking here.

If you are interested in learning more about the different ways that churn rate can be misleading, you can also have a read at the following article written on the subject.

16

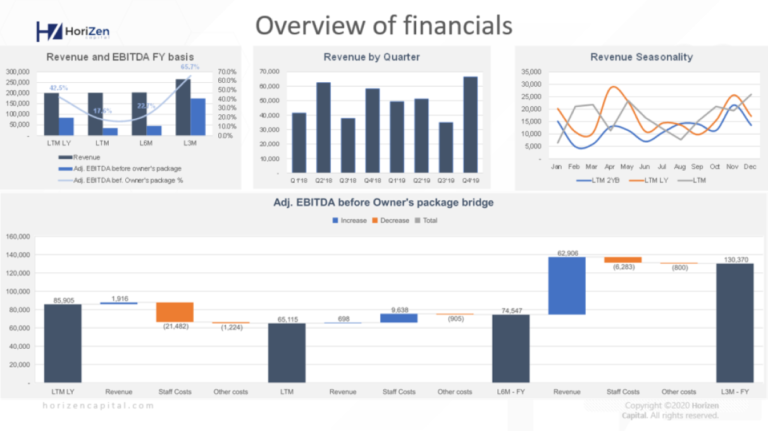

Overview of Financials

In this section of your startup pitch deck, present the key trends in your financials in a visual way. Personally, I like using bridge charts, but I am very aware that 5 years in a Big 4 or Strategy Consulting firm will likely do that to you.

So what I would suggest is to build a bridge of Revenue and a bridge of EBITDA (or net result) and show the main movements to explain how your company financial situation evolved over the past 2-3 years. Make the chart take half or all of the slide and add comments using call-out boxes to make it easier to read.

For your revenue bridge, if you have made a change in pricing in the recent years showing Price effect / Volume effect to show the impact of such a change can be very insightful. For your EBITDA bridge, you can usually show a revenue increase effect and a gross profit margin effect to quickly show the impact of the change of your gross profit margin.

Another thing you can show is the evolution of your monthly net working capital broken down by elements (Account receivables, Account payables, Inventory etc.). However, this is generally less relevant for SaaS companies which often do not have to deal with inventory and have their customer’s credit card on file and charged upfront.

Think of it as a dashboard with the main financial metrics you want to present. There are many ways to do so, and one example is shown below:

Startup Pitch Deck – Overview of financials – Dashboard

17

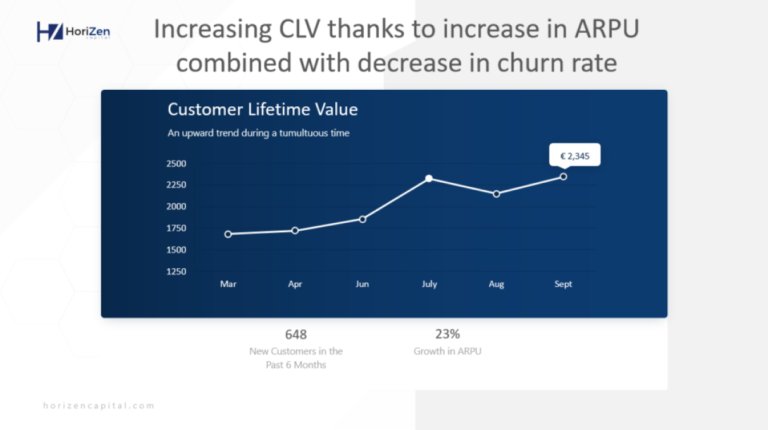

Graphic Representation of your MRR growth / ARPU growth / LTV growth

While you have shared a list of operational metrics as of today in section 15, use this section to show the evolution of the most advantageous metrics over time. Say you have managed to double your ARPU (Average Revenue Per User) in the past 24 months? Showcase that!

Your MRR (Monthly Recurring Revenue) has consistently grow month on month? A simple line or column chart will be more than enough to get the message across.

An example of a visual representation is shown below. You can replicate that view for any relevant metrics you want to showcase:

Startup Pitch Deck – Historical LTV Chart

18

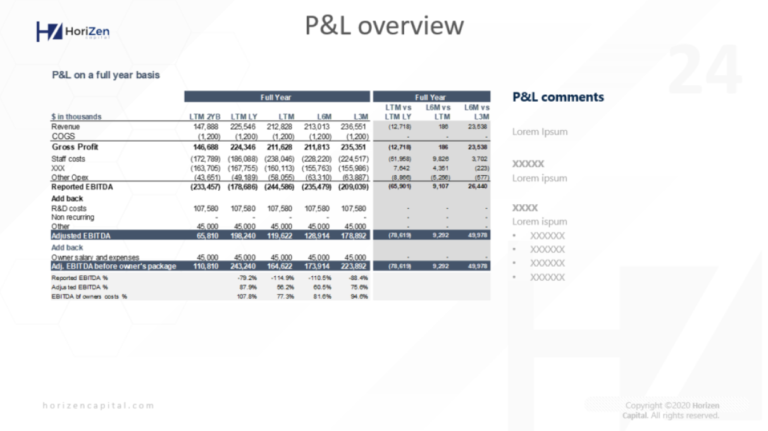

Summarized and Clean P&L

The point of this section and the two following (Balance Sheet and Cash Flow sections) is that investors will want to look at proper financial statements, so make it easy for him and share a nicely presented, neat view of your financial numbers. To make it easier for them understand, add comments on the side on the main changes / cost lines to explain their nature.

To make it more interesting for the investor, also add year on year movements on the side and include classic KPIs under your P&L (eg. Gross Profit %, EBITDA %, # of FTE, average sales by FTE etc):

Startup Pitch Deck – P&L Overview

19

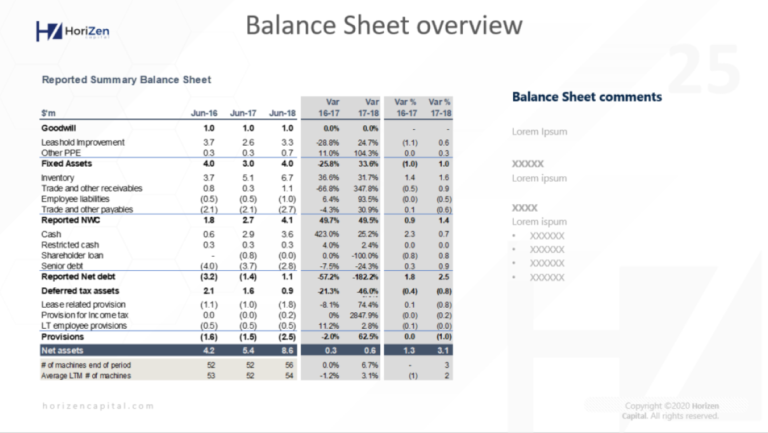

Summarized and Clean Balance Sheet

The point of showing the balance sheet is for the investor to have a better idea of what your net debt / cash position looks like, understand your Net Working Capital and identify is there are any provisions he should be aware of.

Personally, rather than the “classic” presentation of the balance sheet (ie. LT Assets / ST Assets LT Liabilities / ST liabilities) I favour a presentation that directly shows net debt / net cash position, working capital, fixed assets and total net assets.

Here is an example of the Balance Sheet:

Startup Pitch Deck – Balance Sheet Overview

The point of this section and the two following (Balance Sheet and Cash Flow sections) is that investors will want to look at proper financial statements, so make it easy for him and share a nicely presented, neat view of your financial numbers. To make it easier for them understand, add comments on the side on the main changes / cost lines to explain their nature.

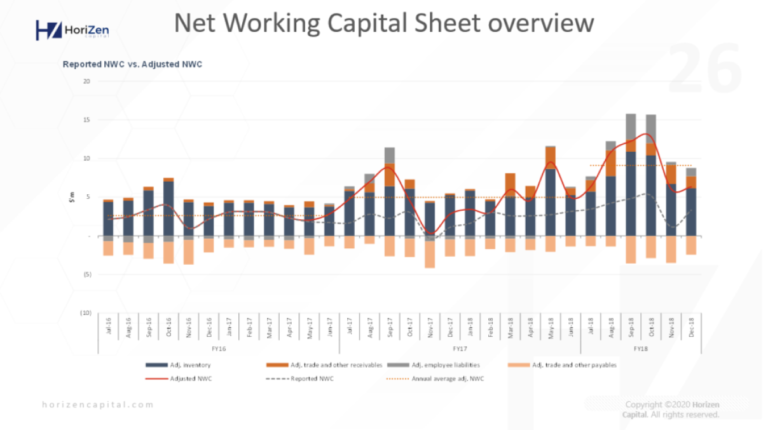

The example below is more advanced than what most of pitch decks will require because this is the type of chart that we present while doing advanced financials due diligence work, however the idea of presenting the NWC per component remains the same:

Startup Pitch Deck – Net Working Capital Overview

20

Summarized and Clean Cash Flow Statements

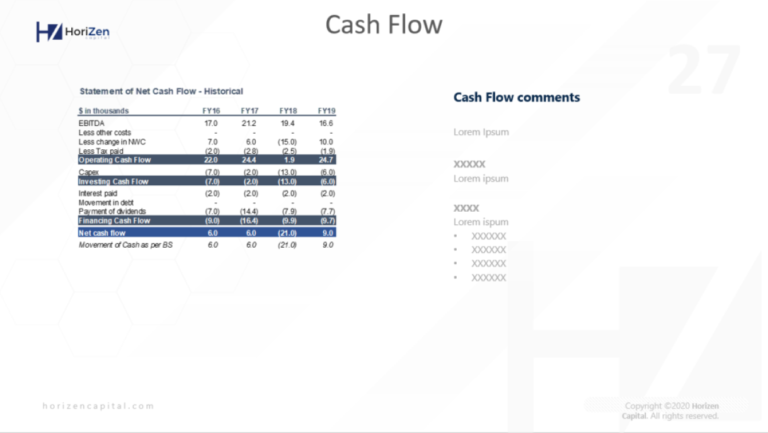

Cash generation is one of the most solid indicators that buyers will look at in the context of a Private Equity buyer looking to acquire a profitable business. Understanding revenue and costs recognition or other account procedures can take a bit of time for a potential buyer to wrap their head around, however looking at the historical cash generation is fairly straightforward.

It does not mean that cash generation reflects the exact reality of the business, as a seller you may have recently invested in Capex for the future, or you may have had a recent increase in NWC impacting your cash generation. However, said simply, if your business has been consistently generating cash inflow for the past 3 years, there is little room to argue that the business has not performed well historically.

Even if you don’t have a strong history of positive cash flow, it will still be very important for a buyer or an investor to understand the mechanics of your cash inflow and cash outflow, and in order to do so, show a breakdown of your cash flow broken down between operating cash flow, investing cash flow and financing cash flow.

For more details on how to prepare a good cash flow statement, please have a look at this article on how to easily prepare cash flow statement that I wrote on the subject. It will walk you through the step by step process of how to easily build a cash flow statement from a P&L and a Balance sheet.

A example of how to present your cash-flow slide in your pitch deck is included below:

Startup Pitch Deck – Cash Flow Overview

4

PART 4

Transaction

At this point any serious reader should have a good understanding of who you are, what you sell, how you operate and how profitable and how much cash flow you generate. It is now time to focus on explaining what you expect from a partner or a buyer. For an investor, it can be quite frustrating (and, believe me, not uncommon) to review a pitch deck and not clearly understand why that pitch deck was sent to you in the first place.

If you have followed this article carefully, your investors should already be aware of the main outline of what you are looking for from the Section 2 of your pitch deck – Investment Highlights! So now, repeat what you have already said in the introduction and give more flavour to the prospective buyer or investor.

Here are some classic sections and content that you can include.

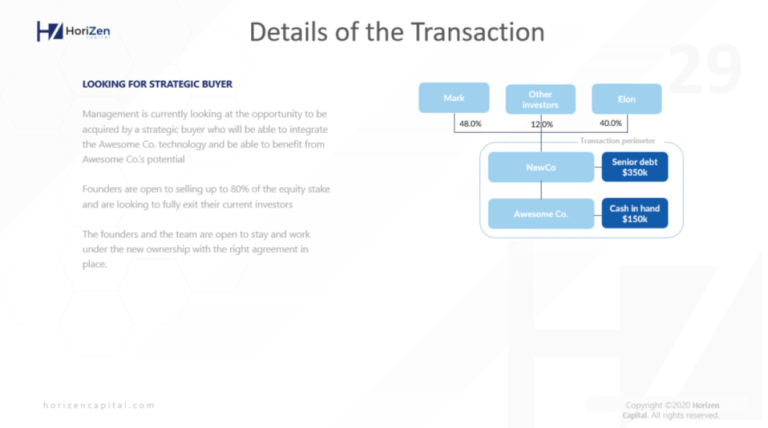

21

Operational Metrics

In more detailed words, what are you looking to achieve? Classic things that you should be mentioning are:

- Are you looking to sell the business or to raise money?

- If you are raising, how much are you expecting to raise?

- If you are selling, what % of the company are you looking to sell?

- Do you have a specific type of buyer in mind or are you open to any offer?

- What does the current cap table of the company look like?

- Are there any convertible / dilutive instruments investor should be aware of?

- If you are doing a carve-out, or if your company has subsidiaries / joint-venture etc, present a simple chart showing clearly the perimeter of the Transaction

You can also mention whether the team is meant to stay with the new buyers / whether it is important for you as a founder to stay or on the contrary if you desire to move on to your next project. Different buyers will have different expectations and a founder staying or leaving may be a dealbreaker depending on who is the buyer you’re dealing with.

Also, another important part of the transaction should be mentioned in this section:

The expected valuation of the company!

There are two schools of thoughts to go about that:

- On the one hand, some entrepreneurs and advisors believe that they have done the work and should be straightforward with their expectations, maybe aiming a bit

- higher to set the tone and keep some negotiation room.

- On the other hand, there are people who believe that potential buyers or investors should be the ones assessing the value of the company first.

To be honest, from my own experience I cannot say which approach is the best, or if we could ever say one is better than the other. So, pick whatever approach you feel more comfortable with.

The most important part is to be prepared, to have done the work upfront and get a solid idea of what to expect even if you do not communicate about it. In any case, be prepared to have solid arguments to negotiate, but also remain open minded. If you continue to only get offers at half the price of what you were expecting, chances are you are overvaluing your company.

In the end, always remember that the market value of your company is never worth more than what the highest bidder is ready to pay for it!

A simple example of such a slide can be seen below:

Startup Pitch Deck – Details of the Transaction

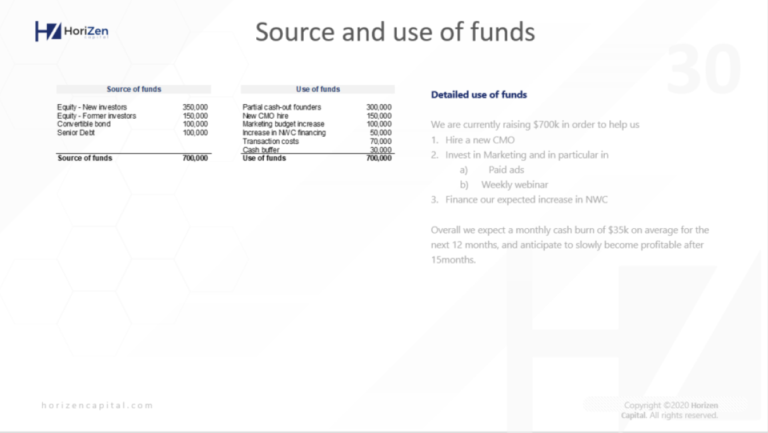

22

What the Funds will be Used For (for Fundraising)

In case you are fundraising, it is important that you know what to do with the money investors are going to trust you with. Saying that you want money to accelerate the growth is never enough. You should logically already have mentioned strong elements in your growth strategy / roadmap section and this section is your chance to be a bit more numerical with it.

The simple way to present which will feel very familiar to investors is to do what is called a “source and use of funds”. As stated by the name, this consists in a table where you would list the different sources of funds that you expect for the financing round. The most classic ones being

- Founders / team’s own money

- Existing investors reinvesting

- Mezzanine debt

- Government loan / subsidiary

- Convertible bonds

- Senior debt

- And, of course money from new investors

On the other side of that table, you should present a breakdown of what the money will be used for. For example, the left side of your source and use of funds may look like this.

- Inventory build-up

- Sales associates

- Increase in marketing

- CMO hire

- New stores opening

- Fundraising legal and transaction costs

The idea of this exercise is to have the sum of your source of funds being equal to the sum of the use of funds. This is super important because an investor’s decision whether to invest in your company or not may depend on where you intend to use the funds.

From a risk perspective, it would be much easier for an investor to invest in a company requiring capital to build-up inventory and fill-up orders rather than in a company that want to start experimenting and investing in marketing, hoping that it will bring enough new sales to turn a profit.

To be clear, Source and Use of funds are originally not used in this purpose, but rather to make sure everyone is clear on the sources of financing and the use of funds as part of the Transaction (ie. founders cash out, capital raise, debt refinancing etc.). I’m just using that structure and conveniently turn it into a “use of funds” from an operational perspective.

An additional thing that you can present here is your expected cash burn rate and how many months you expect to be able to survive on the fundraising before either turning a profit or needing to raise another round.

Consideration around cash burn is also extremely important because it will help your investor know if in their opinion you are raising enough money, and whether there will likely have one or several next rounds during which they will be diluted.

From a founder perspective, the temptation to raise a minimum amount now and more later can be understood, because on paper you would rather raise more at a later round and a higher valuation which would help you retain more % ownership. However, keep in mind that any round of financing is very time consuming from a founder perspective and that you would likely be better off raising 18 months of run rate at once rather than going back on the road to fundraise 6 months after closing your previous round of financing.

Remember – each time you need to fundraise, remember that you are actually at risk of not finding investors to support you.

Here’s an example of what I just described below:

Startup Pitch Deck – Source and use of funds

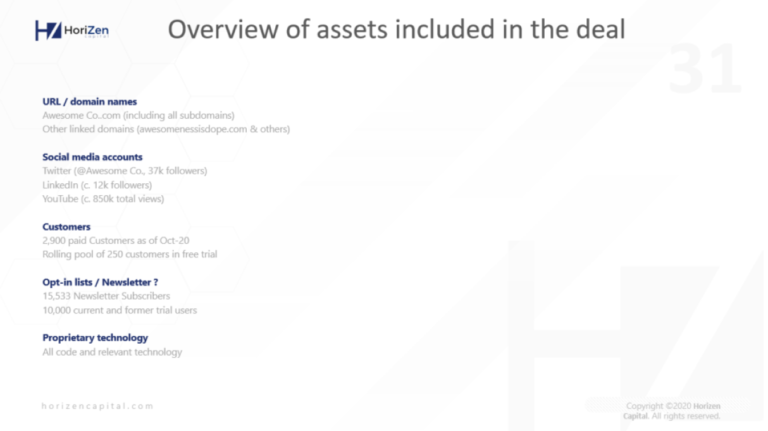

23

Overview of Assets Included in the Deal

This slide is most common in cases where you are trying to sell your business, and maybe even more so if the deal is meant to be an asset deal. I would say that this section is not essential but is a nice to have, especially if you can showcase a good online community and engaged followers.

The idea is to simply give a list of the physical and digital assets included in the deal. Some examples include:

- Inventory

- Storage space

- Domain names

- Facebook / twitter / Instagram accounts and # of followers

- Newsletter/email list

- Patents/ IP/ Code

Keeping it simple, this slide can look like the following example :

Startup Pitch Deck – Overview of Assets included in the Deal

24

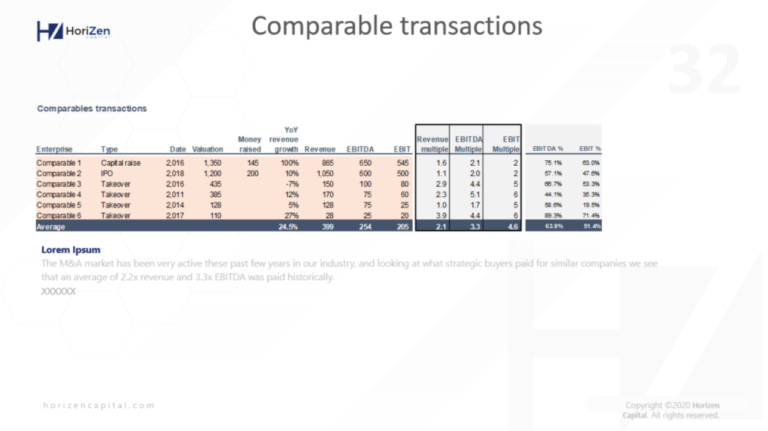

Comparable Transactions

Most buyers and investors, if not all, use comparison points on what is happening on the market to try to assess the fair valuation for a company. Exactly like you would do before buying real estate property to try to assess the price of the property, they will look for data on how much buyers paid for similar-sized companies on the same market.

Doing that work yourself and proving that the M&A market is active and show good valuation could help you set the tone and also implicitly communicate to the buyer that based on objective comparison points your expectation will be in the same ballpark of what is happening on the market, which may be useful if you’ve adopted the strategy of not communicating a valuation number and let buyer offer a number first.

For smaller companies this information is fairly hard to find because most private deals do not disclose the financials nor the price paid for their acquisition. You can either use Google and try to find articles mentioning information, go through the financial statements of the buyer if it’s a public company, or you can try using websites like Pitchbook.

If you lack proper financial data, you can still mention who acquired who without indication of the price paid if that can serve the purpose of demonstrating to strategic buyers that their competitors have been acquiring similar companies to yours.

If you cannot find any data for the size of your company, one alternative solution is to use valuation of larger companies, even public companies’ multiples in your industry to show the trend in valuation if you can show that multiple are increasing. However, keep in mind that it is not because public companies in your industry are valued at 10 times revenue that you can expect the same multiples.

A template example of how you can present your analysis of comparable is as follows. I would recommend to also include the source of your data for investors to test the reliability of the numbers:

Startup Pitch Deck – Comparable Transactions

5

PART 5

Founders Q&A (optional)

25

Answers to Typical Questions Investors Will Ask

This section is optional. The idea is to provide potential buyers with a list of questions and answers that they will very likely ask anyway down the line. When you can, you would rather answer questions once and for all rather than repeating yourself over and over again in calls and meetings.

One of the main reasons not to include one from a process and time management perspective, is to avoid putting up work before any serious buyer is around the table.

As a founder this is extra work to produce, and another way to go about it rather than including it in the pitch deck or info memorandum is to build that Q&A list based on what interested buyers ask you. Instead of anticipating every question and spend a day or two putting this together, an alternative is to write down questions as they come and to compile your answers into one document that you regularly update and can send to new prospective buyers.

In a more complex process, for bigger companies, this Q&A process is generally done as part of the dataroom which includes a Q&A section where buyers can ask questions and sellers answer them when they see it fit.

If you would rather prepare everything before reaching out to buyers and include that Q&A section in your pitch deck, this gives you an extra opportunity to go on about why you think your business is great. While the rest of the pitch deck is meant to be visual, impactful and tick the boxes of a potential buyer or investors, the Q&A session is only going to be read by investors that want to learn more after digesting your pitch deck. It is your chance to express your voice and dig deeper into details that are important to you.

Typical questions included in this section will include:

- What is your reason for selling?

- What did you try in the past which did not work?

- Can you confirm who needs to agree on this sale for this Transaction to happen on the Seller’s side?

- Would you like to stay involved in the day-to-day of the business?

- Would you be willing to commit to a transition or training period?

- Would you like to stay involved in the day-to-day of the business?

- Who would you say are your main competitors and how do you differentiate from them?

- What are the main obstacles that have refrained you from growing faster?

6

PART 6

Appendix

26

Additional Information or Documents

Finally, the appendix section is here for anything you would like to share and which was not easily integrated within your main pitch deck design, that you think adds value.

Similar to the Q&A, generally only interested parties will go through the appendix. So up to the Q&A section, everything is meant to make people want to engage with you. Founders Q&A and Appendix are there to feed the appetite for information of the most interested buyers. In other words, you can see that section as a “if you want to learn more” section!

Some examples of things that would be useful and great to add in to the Appendix section are:

- Articles published on your company from renown sources

- Links to videos of your product

- Link to additional stats or report on the market

- Product specs

- Full product pricing

- Extracts of important contracts

27

Get in Touch Slide

To conclude nicely your pitch deck presentation, add a slide at the end containing your contact information and how prospective buyers and investors can simply get in touch! This is especially important in case you are freely sharing your pitch deck without requiring a NDA. In such case it is likely that your investor deck will be forwarded to other parties that do not necessarily have your email or phone number.

The layout of such a slide is fairly simple and will be our last example:

A template example of how you can present your analysis of comparable is as follows. I would recommend to also include the source of your data for investors to test the reliability of the numbers:

Startup Pitch Deck – Comparable Transactions

This concludes our article on how to put together a great pitch deck.

Remember, keep your presentation visual and straight to the point. Start working on the structure, or just use the one I’ve suggested and twist it to your own needs, and then feel the blanks where the key points you want to advertise.

If you manage to follow the above steps and the pitch deck example, you should have a presentation template that answers expectations from investors and will make a good first impression. Now that you are confident you have the right communication material, it’s your time to get down to work and make sure you close that deal!

If you are a SaaS owner and are interested in going further and learn about how to value your business, you can have a look at our article on how to value a SaaS company.

Connect With Pierre

Feel free to connect with me, Pierre, on Linkedin and on Twitter where I regularly post about new articles, opinions and interesting materials that I find on the world wide web about investing, business ideas, SaaS, soft skills, psychology and communication amongst other things! If you’d like expert advice or hire a HoriZen consultant to assist you in either sourcing a Strategic Buyer or Capital Raise project, get in touch with us today!