8 Important SaaS Trends For 2021 & Beyond

05/18/2021

How To Increase Traffic, Users & Revenue With a Scalable Marketing Playbook

06/08/20216 Startup Principles That Every SaaS Founder Must Know

The genesis of this was really, I had some downtime at the end of last year, and I just started thinking about my history as an investor, all the years that I’ve spent in this industry, and just trying to piece together the similarities that I’ve seen emerging from great businesses, great founders, and ways that you can kind of pull those things together and form a coherent view. It wasn’t me trying to create some great source of knowledge or anything, it was, funnily enough, I started seeing those things and I started seeing a lot of overlaps in startup principles with all the founders that I talked to day to day.

Often you have a discussion, and a couple hours later, you’ll be having the same sort of a discussion on some similar topics. I thought it was just a nice way of kind of integrating both of those works, different thought pieces into one. I can just kind of touch on each of the startup principles very briefly.

Startup Principle #1: How Do You Figure Out How Much Capital You Should Raise?

This is really often one of the most frequent discussion topics, is how much capital should be raised is something that we get asked a lot. I think my startup principle strongly is: only raise what you need from an investor. I think if you raise more capital than you need, you tend to see inefficient business decisions. And the other common question is, how do I work out how much capital I really need?

I propose that you should be able to form a budget for a one to two year budget at a 10 to 20% buffer. Be optimistic with your budget, but you can use hard numbers to come up with this level, because it’s funny how often you see founders going out to raise capital, and they’ll say, “we might want five, we might want 10 million and we’re going to see where it lands”. But I think you need to have slightly more of a data and analytical driven approach.

Startup Principle #2: Staying Laser Focused

I’m a really big believer in focus in any aspect of what you’re doing. I think when it comes to being a startup founder, you really need to just nail your core proposition. Don’t try and go out and do 50 things at once. Think about the one core thing that’s going to make your business succeed, and really invest a lot of time and resources into doing that and then once you’ve nailed that, and you feel comfortable, then go out into the other areas.

It’s funny how often I’ll talk to founders and people, and they’ll be like “here’s the 510 things that I’m going to be doing in the next 12 months, I’m going to launch in this market, I’m going to do all these new product features”, and I say, Okay, well, why don’t you slow down a little bit? Let’s really dig into this core part of your business, because that’s what’s going to be the success or the failure factor.

Startup Principle #3: Follow Your Customers

I think this is also really core to any business in any walk of life, the concept that your customers are the people who are using your product, and they’re probably the people who are going to have the best indication of what’s working and what’s not working, where you should be going.

Always follow your customer, it sounds really kind of logical, but any strategic decision you’re going to make, should have that in the back of your mind.

Are my customers asking for this? Is there going to be demand for this? How should we price it? Think about your customer.

Startup Principle #4: Not All Investors are Created Equally

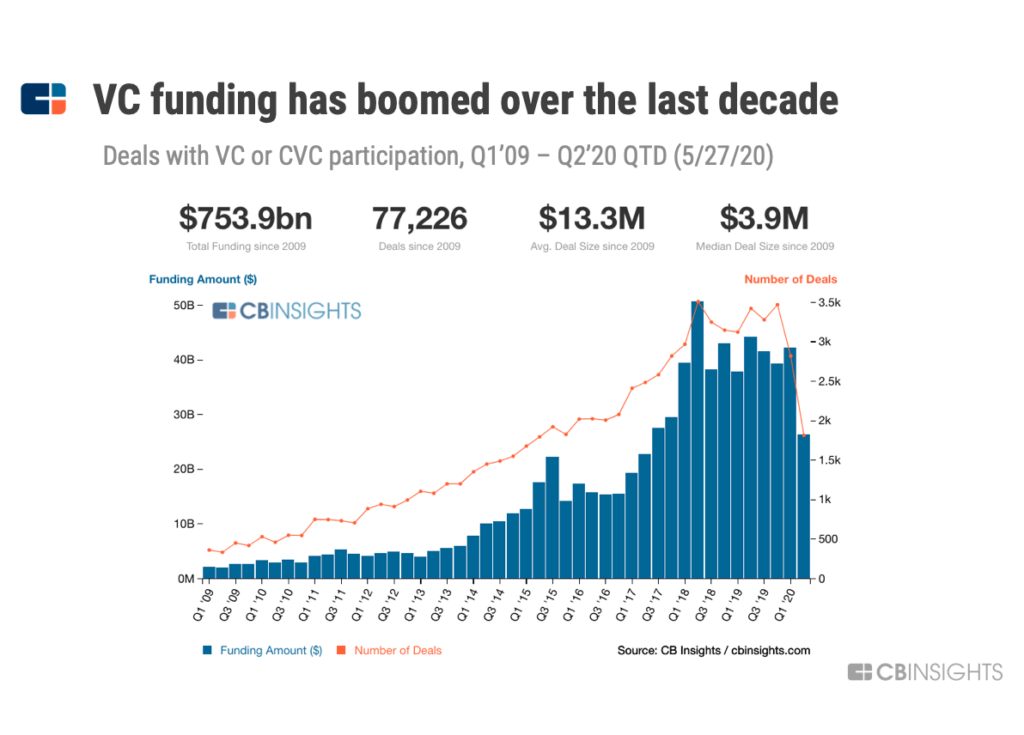

I think it’s slightly self serving, to me kind of like trying to say why we’re different. But there’s a huge number of investors in the market these days, and there’s really no shortage of capital for promising SaaS businesses or businesses in general.

If you have a strong vision, you have a strong team, you’re probably going be able to go raise money, right? Then it comes down to who is the best investor for me at this stage in my business.

There’s various elements that are tied here, but for me the most important ones, it’s like cultural fit, any investor that you pick, you’re going to be working with this person for five years or for 10 years. You want the person sitting next to the table to be like a friend almost, you can go to the pub with them, you can get a drink with them, but they also kind of give you the hard truths and realities. So I think that’s really number one.

Then it’s various other ones around like domain knowledge, obviously, you want your investor to know the market almost as well as you do. You want them to be able to add value, help with hiring, help with operational elements.

Network is what you really want to get, it’s not just money these days, from an investor, it’s the operational ability to add values by what I say.

Then really like my fourth element here is just the concept of share of mind. We’re obviously people, as some investors sit on 10 boards, they sit on 20 boards, as a founder, you really want your investor to have share of mind, if they sit on 20 boards, 10 boards, how are they going to be able to allocate enough time to help you really grow along that journey? So it’s just some of these things, you know, people don’t think about them as much, but I think they’re really important.

How to Choose Between Smart Money Versus Any Investor Money?

I think it definitely works both ways. Like in any relationship, any time I start investing is like a relationship that works both ways, and both sides of the table need to get along and 100%. For us, funnily enough, like cultural fit are a huge element of what we do. You need to not just bind to the vision, you need to bind to the team who’s going to enact that vision, and you need to feel comfortable that you’re giving these people money, and you need to just understand that they can, and believe that they can get there. So, for us cultural fit is really, really important.

Startup Principle #5: Look In the Mirror, Before You Look Out The Window

It’s kind of like a funny little analogy or vision to have there but I think a lot of the time, as startup founders, you can get really focused on what your competitors are doing. You can sit there, and you just press a lot about it, you can spend most of your days looking at what are their updates, what are they doing, but really, particularly as you’re an early stage business you really need to focus on yourself.

Your number one priority should be how do I make my business the best possible version? That dream and that vision, and then what everyone else is doing in the market is not relevant. If you can build an amazing business, everything else will kind of fall into place. I think there’s an element that I’ve touched on here is that there’s a bigger risk that you fail on execution, rather than somebody kills you along the way.

As a startup founder, you need to keep tabs on your competition, for sure. But you shouldn’t just be spending all your time on that.

Startup Principle #6: Believing Relentlessly In Your Vision And Your Business

It’s so funny, often, when you talk to amazing businesses and amazing founders, they just have this burning fire in them that they know what they’re doing is right.

They quite frankly, don’t give a shit what other people are going to tell them. They believe we’re going to get there, and they make it happen. And, as an investor, that’s something that you really want to see as well, you want to see a founder who just understands what they’re doing, and they know they’re going to get there.

About Joseph Pizzolato

Joseph Pizzolato is an Entrepreneur & Tech Investor at Felix Capital with 10+ years of experience investing in, advising and operating companies across Europe and the USA.

He was previously at Vitruvian Partners, a global growth equity fund, where he specialized in B2B Software, Fintech and Consumer Internet businesses. He was involved in a number of high profile investments across countries, including Pindrop, Ebury, Standish and Farfetch.

Check out the full podcast interview with Joseph Pizzolato on SaaS District here.